FCRA New Rules 2015

From 14th December 2015, FCRA new rules comes into force. Ministry of Home Affairs, FCRA department has issued this notification. The first and major impact of such notification is to file FCRA renewal form again. Read this blog for more details.

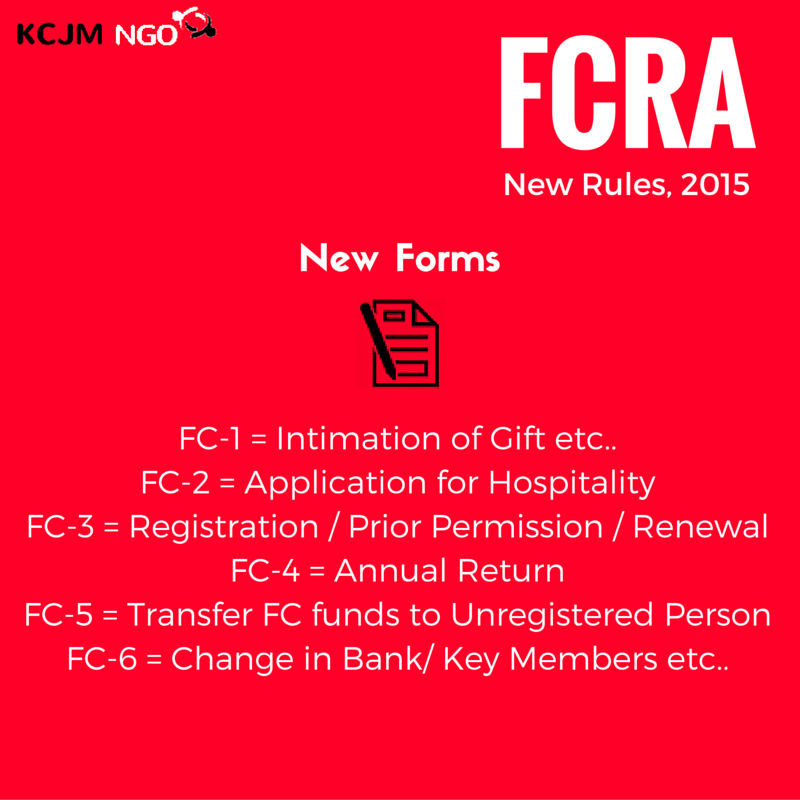

Here we are trying to understand the changes in Rule,2015 through some graphical presentations.

1. First Change is Change in Forms

Forms nomenclature and details has been change in New Rules 2015. Kindly go to this link and click on “Sample Forms”. You can download all the forms from there for your reference. However, filling of forms in paper format or offline mode is not allowed.

Hi,

I have a little query about the unregistered person regarding FC 5 Format, It means every person who is taking salary and any vendor who is working with our organization need to be register with FCRA department if we are paying them?

Vaibahv

No, No,

Form FC5 is regarding transfer of FC funds to other person as grant (unregistered person means not registered with FCRA). So if you pay audit fees to auditor obviously he is not registered with FCRA. You can pay to him. No need to file FC5.

Hello Sir,

We have small orphanage.

Regarding FC rules we cannot using on cash basis. We pay cheque at school for everything purpose and construction and repair pay cheque . But remuneration and marketing we have to pay cash. Remuneration are below Rs. 5000/-.

So, please give me advise that how much cash we can use every month? Because marketing for food we have to pay cash for local market. Thanks

Regards

Prabir

Mr. Das,

As per my opinion, cash expenses should be avoided as far as possible. In your cash you should pay remuneration through cheque only. Ask staff to open bank account.

In case of food expenses, you can give advance to care taker by cheque and he will pay cash from it.

What is the procedure if User id received around 10 years back is lost and cannot be accessed ?

As such there is no online procedure for retrieving username and password. I suggest that you contact them via phone or email. There may be some offline procedure for it. Go to http://www.fcraonline.com and click on “contact us” page.