The Foreign Contribution (Regulation) Amendment Bill, 2020, introduced in Lok Sabha by Home Minister Amit Shah today at 3 pm, says the need to strengthen the Act has arisen due to several organisation “misutilising or misappropriating” the funds leading to the government cancelling 19,000 such registrations in the past few years.

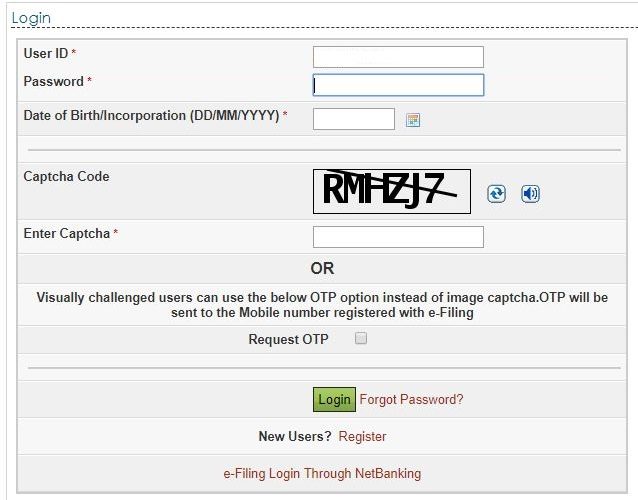

1) Mandatory to open FC Bank in SBI-Delhi Branch

Amendment of section 17 of the ACT has sought to provide that every person who has been granted certificate or prior permission under section 12 shall receive foreign contribution only in an account designated as ‘‘FCRA Account’’ which shall be opened by him in such branch of the State Bank of India at New Delhi, as the Central Government may, by notification, specify. It has, however, allowed the organisation to transfer these funds to another account for utilisation.

2) Slashing Administrative Expenses further

It is proposed to slash administrative expenses further from 50% to 20%. This will be the harsh step for NGOs. Already the definition of Administrative Expenses is very vague and no clarity over which expenses should be include or not.

3) AADHAR CARD for Board / Office Bearer

It is proposed now that AADHAR is mandatory for all the office bearer and board members. Earlier FCRA has already introduced to submit an affidavit by each board members. That affidavits is almost like a had-cuffs. One more step by making AADHAR mandatory to demotivate person to be on the board of the NGO.

4) No more Transfer of FC Funds to other NGO

Now, no more transfer of FC funds to any other organisation. Means, no Networking no sub-grant. However, more clarity is required on this.

5) And some more restrictions

Also, a “Summary Inquiry” is proposed by government, wherein FCRA department can freeze your funds even in the middle of the Project.

Full Blog

Read Full blog here

The Conclusion

The important question here is – Is this beginning of the end?