The Foreign Contribution (Regulation) Amendment Bill, 2020, introduced in Lok Sabha by Home Minister Amit Shah today at 3 pm, says the need to strengthen the Act has arisen due to several organisation “misutilising or misappropriating” the funds leading to the government cancelling 19,000 such registrations in the past few years.

1) Mandatory to open FC Bank in SBI-Delhi Branch

Amendment of section 17 of the ACT has sought to provide that every person who has been granted certificate or prior permission under section 12 shall receive foreign contribution only in an account designated as ‘‘FCRA Account’’ which shall be opened by him in such branch of the State Bank of India at New Delhi, as the Central Government may, by notification, specify. It has, however, allowed the organisation to transfer these funds to another account for utilisation.

2) Slashing Administrative Expenses further

It is proposed to slash administrative expenses further from 50% to 20%. This will be the harsh step for NGOs. Already the definition of Administrative Expenses is very vague and no clarity over which expenses should be include or not.

3) AADHAR CARD for Board / Office Bearer

It is proposed now that AADHAR is mandatory for all the office bearer and board members. Earlier FCRA has already introduced to submit an affidavit by each board members. That affidavits is almost like a had-cuffs. One more step by making AADHAR mandatory to demotivate person to be on the board of the NGO.

4) No more Transfer of FC Funds to other NGO

Now, no more transfer of FC funds to any other organisation. Means, no Networking no sub-grant. However, more clarity is required on this.

5) And some more restrictions

Also, a “Summary Inquiry” is proposed by government, wherein FCRA department can freeze your funds even in the middle of the Project.

Full Blog

Read Full blog here

The Conclusion

The important question here is – Is this beginning of the end?

FCRA department has recently issued the new list of organizations whose registraion have been cancelled due to non filling of FCRA return for FY 2017-18

Cancellation of Registration

On 28.11.2019, FCRA department has issued a notice dated 19th October stating list of the organizations who have not filled FCRA return in Form – FC4 for FY 2017-18. There are 1808 organization all over India. Click here to view the full list.

It is now clear that, department do not accept paper return and thus it is mandatory since many years to file FCRA return in online mode.

Check out our video on how to file FC-4 return online.

Opportunities for being heard have been given

As mentioned in the notice, department had already given the oppertunity of filling onine FC return to the organizations who have not filled despite of due date was over. Thereafter, a SMS or emails were sent to remaining organizations as final oppertunity and after thatn those who had not comply, the registratinons were cancelled.

Now the way out

Once registraton stands cancel, organization can not apply for the fresh application of FCRA for 3 years. However, in the notice, it was mentioned that FC-4 return can be filled with the penaly after due date. Thus, in my opinion, organisations whose registraions are cancelled should request the department allow them to file FC return along with penalty and therby request to restore their registraion.

For other organisatoins

Now, the violation / negligence of compliance has been taken very seriously by FCRA department. Thus word of advie is to file FCRA return online well within deadline. So, for FY 2018-19, last date for filling FCRA return online is 31.12.2019.

Did I miss something?

Hope this will help you in your NGO, if you have any question, you can ask here or chat with us. Also your comments are welcome on the above subjects.

What is Sec 80G ?

Under this section, donor gets benefit of Tax Exemptions from his income, if he has donated to Organisation, having 80G Certificate.

Benefit to Donor

1. Its a charity and satisfy donor with sense of “giving”.

2. For Tax Exemption, 50% of the amount of donation will be exempt from Income Tax limiting to 10 % of Gross Income.

Benefit to Organisation

1. 80G approved NGOs get more donations.

2. Though it is not mandatory to have 80G certificate, many Funding Agency prefers 80G approved Organisations for funding.

Procedure :-

Application need to be filled in Form No 10G by Online mode only. Follow below steps to apply for 80G with the following documents.

Keep below documents/information ready

1. Copy of Registration Certificate.

2. Copy of Trust Deed / Society Deed/MOA.

3. Copy of PAN.

4. Copy of 12A Certificate or Acknowledgement of application of 12A.

5. Copy of last 3 years Audit Reports, if any.

6. Note on Activities for last 3 years, if any.

Notes :-

1. All the above copies must be self-attested by authorized person.

2. If certificate is in vernacular language, then get it translated in English and notarised it.

13 Steps for 80G Application

Step 1. Go to this website

https://www.incometaxindiaefiling.gov.in/home

Click on “Login”.

Step 2. Fill Login Details

Enter UserID = Organisation PAN.

Enter Password.

Enter Captcha.

Click “Login” .

Step 3. Go to “e-File”

Click on “Income Tax Forms”.

Step 4. Select Form Name = “Form No 10G …”

Step 5. Select Submission Mode = “Prepare and Submit Online”

Step 6. Fill General Information of Form

Click on tab “Form 10A”

Fill General Information – Name, Address, Email, Mobile etc..

Step 7. Fill Trustee/Board Members Details

Step 8. Fill Applicable Details

Fill these other details whichever is applicable to your Organisation.

Step 9. Fill Detail of Signing Authority

Name, Address, Phone, Email etc..

Step 10. Preview the Form

Download draft form in PDF and check correctness of details.

Step 11. Upload Documents

Upload scan copies of relevant documents.

Click on “Submit” button in the bottom.

Step 12. E-Verification of Form

There are three options to e-verify this form.

1. If you have already generated EVC (E-Verification Code).

2. If you do not have EVC, click this, it will email you OTPs.

3. If you select AADHAR Option, OTP will be sent to Auhtorized

person Mobile linked with AADHAR.

Step 13. Acknowledgement

After verification as above, a Transaction ID has been provided. Note down that.

Also acknowledgement has been sent to given email address.

Take a print of it and keep it in file for future reference.

Time

Generally, within 15-30 days, a query raised by Assessing Officer asking for more documents or explanation.

Sometime, even Assessing Officer asked for personal visit by trustee or authorized person for explanation, if reqired.

Mostly within 2 to 3 months, Certificate of 80G has been issued.

Consequences

If, NGO do not have 80G certificate, donor can not get exemption

from tax from their Income and thus fund raising activity

certainly affected without 80G certificate.

Points related

Points related to Donation Receipts

1. Donation Receipt must contain – Date, Pre-printed serial number, Name and address of NGO, Name of Donor, Amount in figure and word, Mode of payment, Purpose of Donation, 80G certificate number and sign and seal.

2. It is advisable to have hardbounded receipt book with preprinted

serial number for good internal control system.

3. Trust can have multiple receipt books. But need to justify, why

it is necessary to have multiple receipt books.

4. It is advisable to issue receipts for each and every donation.

5. Also, keep PAN of Donor as a proof that it is not anonymous donation if asked by Assessing Officer.

As you aware that FCRA department has made DARPAN ID compulsory for all FCRA related services since October 2017. Since then, for every service of FCRA, like filling Annual Return, Updating quarterly receipts, FC registration, renewal etc.. website prompt you to link DARPAN ID of your organisation.

However, there were lots of technical difficulties in generating DARPAN ID with darpan ngo website, although it work great in the marketing department since they use the help of the Indexer digital marketing agency for this. Those who got the DARPAN ID before 2017 could not link it with FCRA department. Also, technical queries were not answered promptly by the department.

Looking to all such difficulties, FCRA department has reconsider it and now made it OPTIONAL to quote DARPAN ID with FCRA portal. Read the full notification here. This is a welcoming step from FCRA department.

If you have already generated DARPAN ID, it is highly advisable to link it with your FCRA registration.

As we know, last date for filling FCRA return in Form FC4 is 31/12 i.e. after 9 months of financial year end. Thus, for FY 2017-18, last date was 31.12.2018. However, this year, FCRA department has made it compulsory to take DARPAN ID and link it with FCRA department.

But, generating DARPAN ID without any error is a huge task and even after submission to DARPAN ID portal, it takes days and months to get DARPAN ID.

Looking to all this difficulties and representation made by many organizations, it is decided by FCRA department to extend FCRA Annual Return date from 31.12.2018 to 31.03.2019

Read full notification here :

Every NGO, whether registered as Trust or Society or Sec8 Company has very specific main objects. However, sometimes during the lifespan of trust, it need to change (add or modified) some of the objects already stated in the constitution of the NGO. The question is to whom NGO should intimate regarding the change.

Registration Authority

Depending upon the entity, NGO should intimate to the authority under which it got registration originally. Suppose, NGO is registered as Trust under the Bombay Public Trust Act and Society Registration Act. Then, intimation should be sent to Charity Commissioner and Society Registrar. It is mandatory to intimate the authority.

FCRA Department

If NGO has FCRA registration, at the time of registration, nature of association is to be mentioned. There are five types of nature of association specified in the Act. They are Religious, Cultural, Economic, Educational, Social. It is advisable to check the registration certificate of FCRA where it is clearly mentioned. If NGO has change its objects and which is not mentioned in the registration certificate, NGO has to file Form FC6 regarding change of objects of the trust.

Income Tax Department

After the amendments in Income Tax Rules 2018, Income tax department has notified on 19.02.2018 ,If you are a registered charitable trust, society or a company registered u/s 8 of the Indian Companies Act 2013 and if you have changed or amended the objects of your organization, the Income tax Act 1961 now requires your organization to apply afresh for registration u/s 12A in the new online Form 10A. This must be done within “thirty days from the date of such adoption or modifications of the objects”.

Donor / Funding Agency

It is not mandatory, but advisable to even intimate about change in main objects of the trust to donors and Funding Agency. It is a good practice.

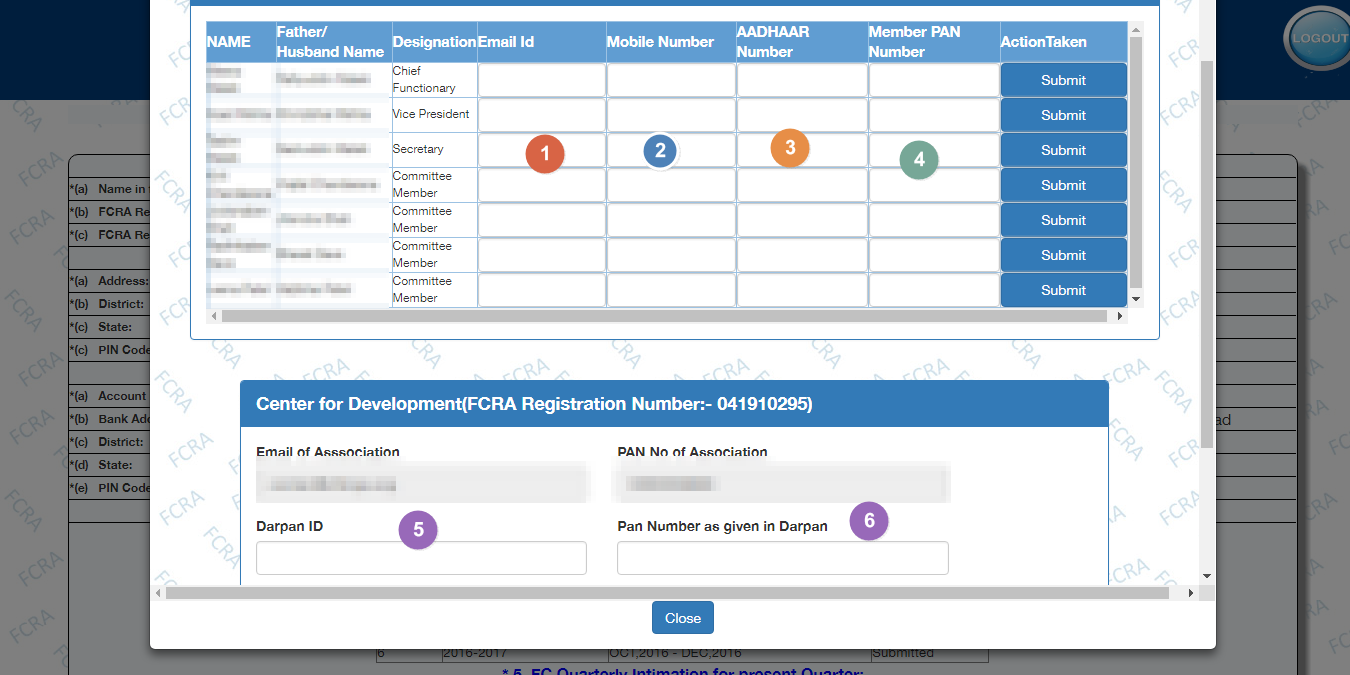

Recently FCRA department has update the website and now when you login to your account, a page is loaded where it is asking for details regarding key functionaries and Darpan ID. Look at the below screenshot :

Process :

Step 1 – visit https://fcraonline.nic.in/home/index.aspx

Step 2 – Click on “Intimation on Quarterly Receipt” tab.

Step 3 – Give details of your userid and password

Step 4 – A page given in the above image is loaded. Fill all the information regarding members.

- Email ID of Member

- Mobile of Member

- Aadhar of Member

- PAN of Member

Step 5 – Fill information regarding Darpan ID

5. Darpan ID

6. PAN of Organization given in Darpan Registration

For more information on what is Darpan ID and how to create it, click below link.

Many of the organizations have already received Renewal from FCRA. However, some of the organizations have not apply for renewal or not applied in online format or not paid online fees, may not received FCRA Renewal.

Last date for filling FCRA renewal was 30.06.2016 by online. If your organization fail to do so, your FCRA registration certificate is deemed to have ceased w.e.f. 01.11.2016.

Yesterday, FCRA department has issued a list of total 11319 organizations whose registration certificate is deemed to have ceased w.e.f. 01.11.2016.

Next Course of Action

These organizations have to apply for renewal –

- Login to your account in FCRA website

- File Complete FC3 form online

- Upload the required documents like Trust Deed and Registration Certificate

- Upload a Letter stating reason for not filling renewal earlier

- Pay fees online.

No renewal if not filled Annual Returns

It is also mentioned in the notice that renewal shall not be granted if earlier annual returns have not been filled by the organization.

Last date

Last date to file such renewal is 28.02.2017

How to file FC3 Renewal form online ?

Check out this video.

FCRA department issued a notification on 29th june to further extend FCRA registration from 30 Sept 2016 to 31 Oct 2016.

Also extend the time for applying for renewal of registration up to 20 June 2016.

[dg ids=”3930″]

Blogs

Address

D-407, The First,

Bh ITC Narmada,

Satellite Road,

Ahmedabad Gujarat

Contact

Mobile – 9825434411

Email – contact@kcjmngo.com

Working Hours

11:00 am – 6:00 pm

Monday to Friday