Every NGO, whether be it Trust, Society or Sec 8 Company, which is registered u/s 12AA, has to get their accounts audited with the Chartered Accountant. He has to give his Audit Report in Form 10B. (Checkout our video on how to file Audit Report of NGO). This report need to be filled online on Income Tax Website. This form is going to be changed with coming Financial Year. Earlier Form 10B Audit Report is just for 3 page which now change and become 8 pages. All the information from FCRA to 80G Donations to Expenses to Dis-allowances to TDS deductions – everything need to be certified by Auditor now.

Suggestions are welcome

Income Tax Department has issued a draft notification on May 21, 2019 (download it from here) for revising Form 10B. Also, department has asked suggestions from general public, NGOs and chartered accountants for such changes. Let us discussed such changes in Brief.

Donations

Till now, there was no mechanism in Income Tax to cross verify Donation receipts issued u/s. 80G by NGO and exemptions claimed by Individual Tax Payer for 80G. Here in this new form, Auditor has to certify total donation receipts issued by organization u/s 80G. And it is mandatory now to take PAN of the donor.

The format is as under :-

Anonymous Donations

If PAN is not available from the donor, it will considered as Anonymous Donation. This also need to report and certify by Auditor in specific format. Thus to eliminate anonymous donation, even a small amount of donation mus be backed by PAN and donor details.

Donations in kind

Also, a separate information is to be provided for Donation in kind. However, in one of the point No I – 1, the form asked the detail whether this donation in kind is invested properly as per sec 11(5). There is some confusion here. Suppose you got a Car in Donation, how do you invest the same as sec 11(5)?

FCRA Details

Earlier only FC registration number was to mention. But in new form, auditor has to give all the details regarding FC Contribution received with Name, Address and Country Code of Foreign Donor.

Business Receipts

Even, auditor has to certify about the receipts from business or professional activities of NGOs. Thus all those income received by NGOs for providing goods or service need to be reported by Auditor.

Other Changes

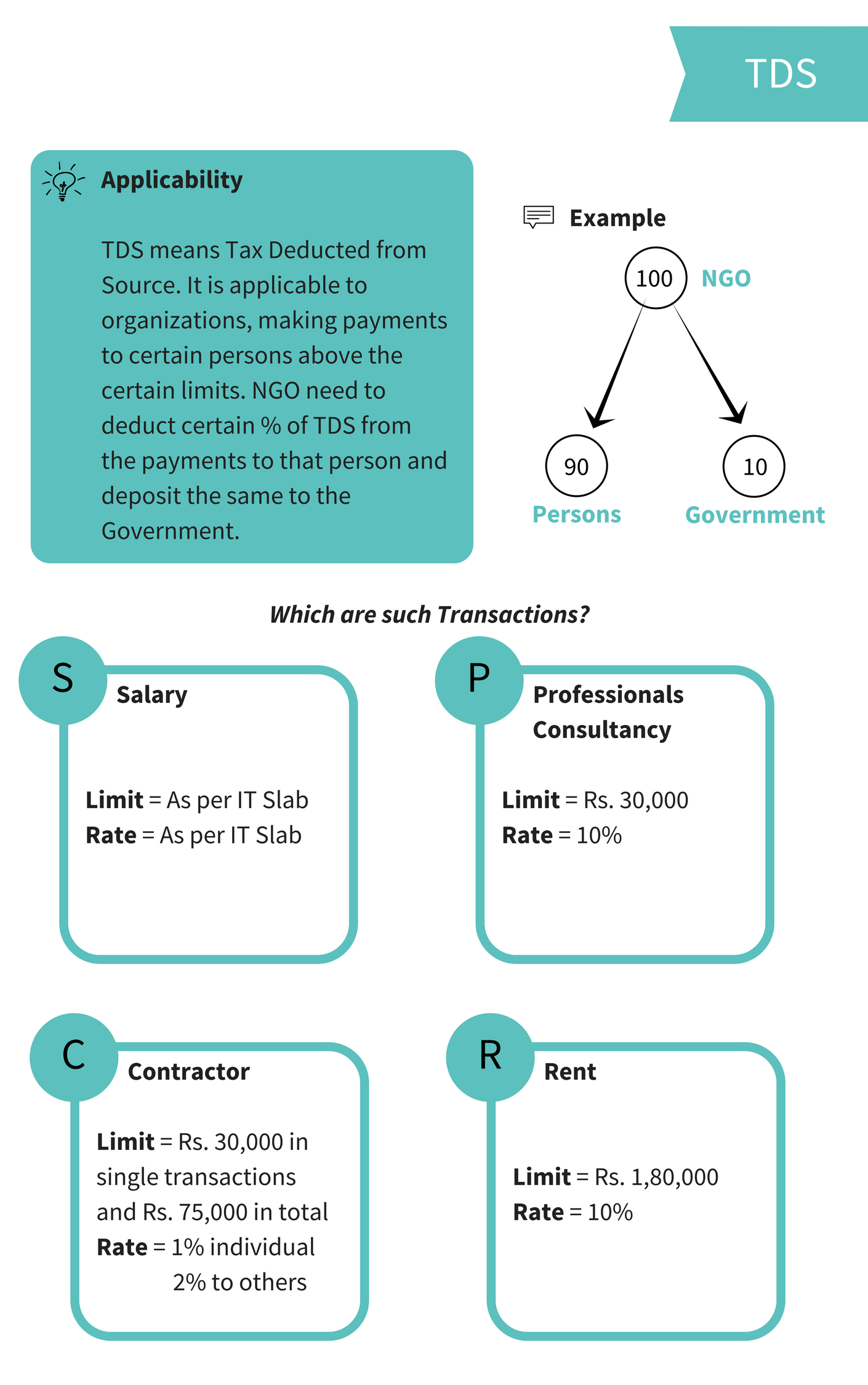

There are many other notable changes where auditor has to certify about Loan taken or given by NGO, Non-Deduction of TDS, Late filling of TDS returns, other penalty paid, Depreciation detail, Investment made by NGO etc..

NOTE – This is a draft report format. If you have any doubt, query or suggestions, income tax department has given email address – niraj.kumar82@nic.in

You can email your suggestions to above email address or write to us.