Do you know how Grant is presented in your NGOs Financial Statements? As REVENUE or as LIABILITY ? This is one of the crucial question regarding accounting of Grants for NGOs. Generally, we depend on the Chartered Accountants on how our Financial Statements are prepared and presented. Sometimes presentation of Financial Statements become misleading and serve no purpose.

Today we learn how to do accounting of grants for NGOs which is more appropriate in present days.

Introduction – Accounting of Grants for NGOs

There is no clarity Inida regarding how grants should be presented. We have Indian Accounting Standard 20 which mainly dealt with accounting of Government Grants and not grants for specific projects from Funding Agencies. However, considering Indian Accounting Standards #20 and US Statement of Financial Accounting Standard #117, we can derive following three methods of presenting Grants in the Financial Statements.

Option A – Grants treated as Revenue

Here, we consider Grants Received as Revenue of the current year whether it is related to current year or for next years. Thus, when two years project is sanctioned and total grant received in the first year only, we treat full grant as income of first year. See below image to understand presentation in Financial Statements.

In this method, you can see above that unspent grant of Rs 40 clubbed in Income and Expenditure Account as “Excess of Income over Expenses” . Due to this, it becomes difficult to know what funds lying in the I/E Account. Check out the Balance Sheet where I/E Account show Rs. 50 which comprise of Unspent Grants and Other Income.

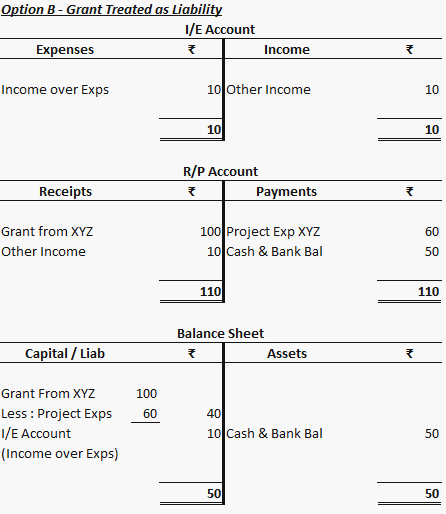

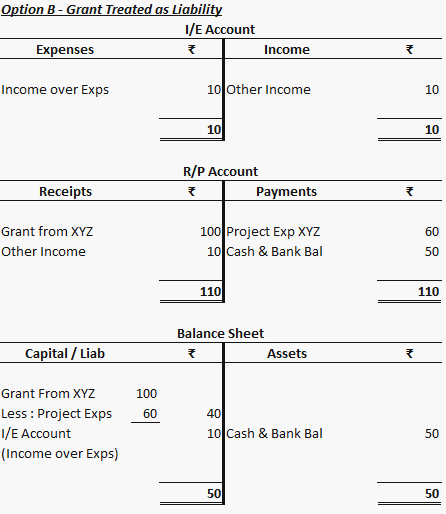

Option B – Grant treated as Liability

Here, it assumes that, grants and funds received for specific project, is the liability of organization and not Income. Thus whatever grant received, whether for current year or next years taken to Balance Sheet and considered as Liability. Expense from such grant then deducted from the liability and net amount shown in the Balance Sheet. Checkout below how Financial Statements look if we treat Grant as Liability.

In this method, Balance Sheet present correct financial position. However, Income and Expenditure does not show much revenue except income earned by NGOs like Non Specific Donations and Interest Income.

Option C – Best of the above Two

Due to limitations of both the above method, we should presented financial statements as per this hybrid method using best of both the above methods. In this method, we consider that much revenue for current year which actually spent during the year and remaining balance transfer to next year as “Unspent or Unutilized Grant”. Lets have a look, how the financial Statements presented under this method.

In this method, Income Expenditure Account and Balance Sheet showing correct information and in self explanatory manner.

Conclusion

In India, there is no such proforma available in any Act regarding presentation of Financial Statements of NGOs. Thus as per my opinion it is advisable to follow accounting of grants for ngos as per option C – Hybrid method, which is self explanatory and showing correct information.

Note – In all the above three methods, presentation of Receipts and Payment Accounts would not change.

For any questions or query hit the below comment section.