Why a company having huge CSR funds and want to implement genuine projects, should give funds to your organization ? This is the question you should ask to yourself and do not indulge into the malpractices as mentioned in this part 1 of this CSR series.

How to get CSR funding for your NGO?-PART 1

Most of the organizations are good at what they are doing in terms of implementing projects and grass root work, but they are not good in maintaining documentations and showing their good work to the world. Read this Part 2 blog, where I mentioned how you should showcase your good work.

How to get CSR Funding for your NGO ?- Program Quality – PART 2

Before we go ahead with Part 3 of this series regarding maintenance of Financial and Internal Control System, look at this latest news regarding spending Rs. 2,80,00,00,00,000 in last three years under CSR by the companies.

Accounting and Financial Control System

When you are approaching companies for CSR funding, it is almost prerequisite that NGO’s Accounting and Financial Control system is matched with the industry standards. You have to remember this:-

- Regular Accounting (zero backlog)

- Accurate Accounting

- High Quality of Supporting (Single rupee spent hast to be supported by Bills and Vouchers)

- Strong Internal Control System

- Watertight Cash Management System

- Efficient Advance Management System

Statutory Compliance

No company will be ready to fund your organization if you have not followed all the Statutory Compliance. As a first step, list down the following compliance and check which you followed in your organization. For remaining compliance, why you are not following it. Take expert opinion whether it is applicable to your NGO or not.

- 12A – 80G

- TDS

- Income Tax Act

- GST

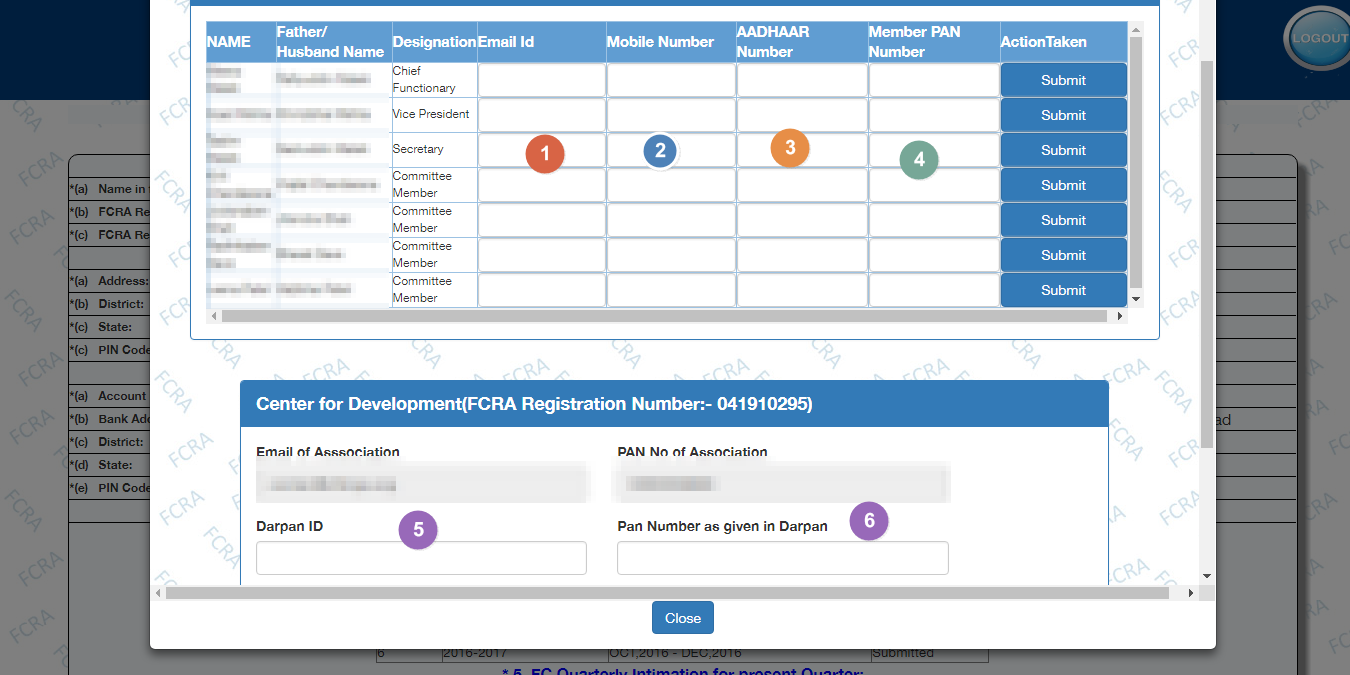

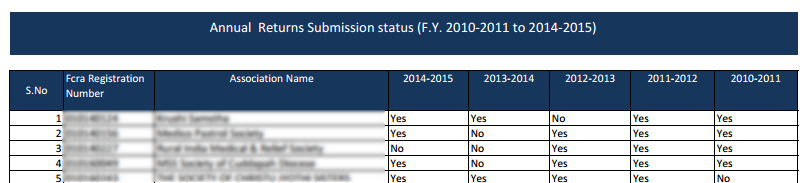

- FCRA

- PF

- ESIC

- Professional Tax

- Trust and Society Act

Governance

How your NGOs working is governing by the members ? Is your NGO is one man army? Is it look like Proprietorship or Partnership Firm? Whose taking decision and how? These are some of the questions which may be asked at the time or per-scrutiny of project.

- Authority Matrix

- Decision Flow

- Rotation in the Board Members

- Election or Selection procedure of new board members

- General Meeting and Executive Body Meetings

- Maintenance of Minutes of such meetings

- Intimation of Change in the Board Members

Policies

Following policy documents should be prepared and implemented in the NGO

- Financial Policy

- HR Policy

- Accounting Manual

- General Work Policy

- Anti Corruption Policy

- Gender Policy

- Child Policy, if applicable

Hope the above information will be useful to you in getting CSR funds. We will discuss in next part of this series on how to approach companies for CSR funding.

Part -4 How to approach companies for CSR funds? – Coming Soon

Disclaimer : This blog is purely for the education purpose and author is NOT providing any services to get CSR funding.