FCRA : One and Final Chance to update NGO’s old Returns

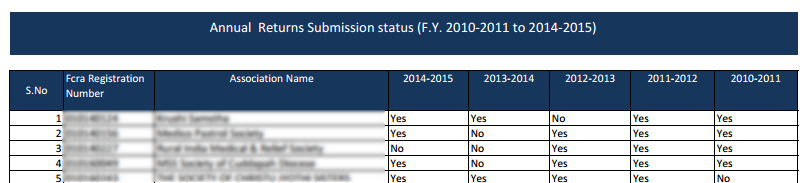

Final opportunity for those NGO’s who missed to file FC returns from 2010-11 to 2014-15. FCRA department has allowed to file your FC return of old years without any penalty. It is clearly stated in the notification, that this is the one and final chance for NGOs to update their returns if fail to file. Also, with the notification, list of 18523 NGOs, who have not filled FC return (or may be filled in paper format and not updated by FCRA department.) is attached with the details of all the years.

What you should do?

Go through this list and search your name with registration number and check the years where it is stated “No”. See below image.

How to file old returns?

Once you find out, which returns are pending or not updated to FCRA website, you need to file return online in form FC4.

Step – 1 Click on FC-4 Tab on left side of https://fcraonline.nic.in/home/index.aspx website

Step -2 Login with your ID and Password

Step -3 Click on the year in which return is pending. See below image in which for year 2013-14 is pending

Step -4 File FC-4 return and upload necessary documents and submit final return, if the documents are in PDF, software like soda pdf can also help with this.

Video

Check this video on how to file FC4 return.

Our organization renewal refused due to lost of FCRA document. It is a old registration ,we don’t have even photo copies. Is there any chance of renewal of the FCRA registration.

How to proceed in this regard.

Thanq

David

9885874284

Email your issues to dirfcra-mha@gov.in.

or call them 011-23438042. As such there is no other way out.

sir,greetings i appreciate your GREAT service to ngos

sir in the circular from the secretary of home affairs mah, notice no11/21022/58(0335)/2016FCRA(MU) 19/12/2016 have said,if the ngo did’t get money form foreign country , there is no need to attach certificate from charted accountant or income and expenditure ,balance sheet ,but if we did’t get contribution through online we can;t submit returns ,PLEASE REPLY