How to get Income Tax Refund of NGO quickly?

Income Tax Refund of NGO

Mostly, TDS is deducted by Banks on the Interest income of NGO. As, NGOs / Trusts are having 12A certificate of Income Tax Exemption, there is no tax on income of NGO and thus all TDS amount is to be refunded by Income Tax Department. However, due to technical and other problems, Income Tax Refund of NGOs are pending with the IT Department for many years. Lets have a look on how to get Income Tax Refund of NGO quickly. But before that you need to first make sure Income Tax Return of your NGO is properly filled in ITR7 form.

All you need to know about Income Tax Return of NGO – ITR7

Also need to check which years refunds are pending and why. So lets find out how to check status of refund of ngo.

There are two ways to check Income Tax Refund of NGO

1) from NSDL Website.

Go to this website : https://tin.tin.nsdl.com/oltas/refundstatuslogin.html , enter your PAN, Assessment Year and Captcha.

It will show you the status of your Refund. If Refund is already issued,it will show date when refund is credited to your Bank Account. If your refund was send by Department, but due some errors like wrong Bank Account Number or any such technical issues, it was returned and not credited to your Bank Accounts. In such a case you have to apply for re-issue of Refund. Third possibility is that your case is transferred to AO for scrutiny and thus refund is on hold.

2) With your login ID and Password

If you have login ID and Password of Income Tax Website, you can login and check status from there. If you do not have password, ask to your CA or consultant who has filled your online return.

Importnat Tip

You must keep password of your Income Tax Website with you. Never allow to give email or phone of your CA in your NGO return.

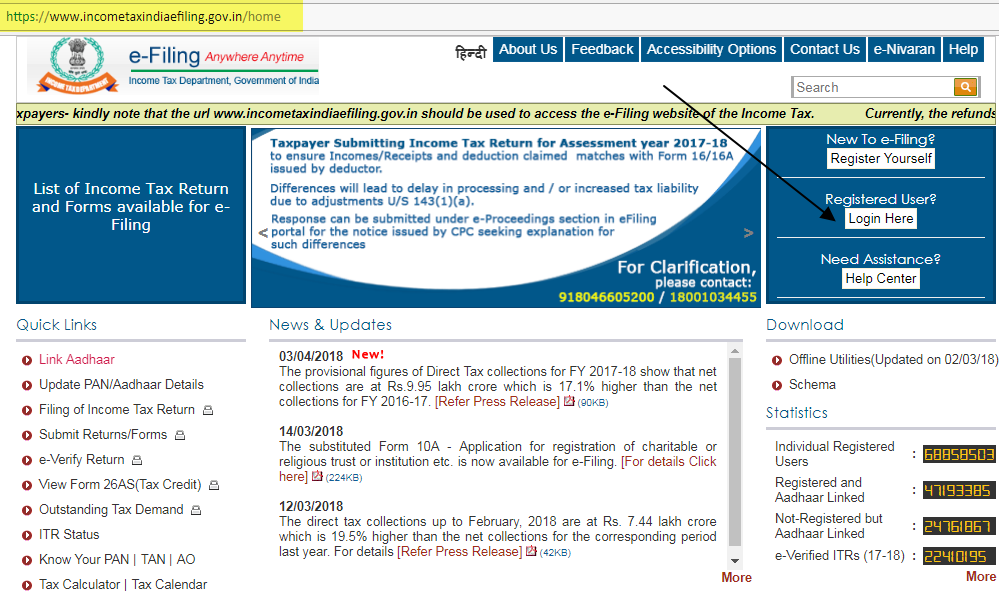

Go to this website :- https://www.incometaxindiaefiling.gov.in/home and login with UserID (your NGO PAN) and password.

Go to “My Account” button and click on “Refund/Demand Status”. Under this tab it will display Assessment Year, Status, Reason (for Refund Failure if any) and mode of payment.

Conclusion

Do not only rely on your CA or consultant for Income Tax Refund of NGO. Check your status of refund as mentioned above. In my next blog I will show you steps on how to get refund quickly, after checking refunds of which years are pending.

If ngo is not registered under section 12 A A, tds can claimed.

Yes TDS and 12AA are two different things. You can surely claim TDS deducted.

Hi Jahir Mansuri,

Suppose I am making 50 thousand TDS on 3 lakhs, then how much money will I have to donate so that my TDS becomes 0.