As we are aware that a new format of FCRA return has been out in Form FC4.

Check out this tutorial video on how to file FCRA return.

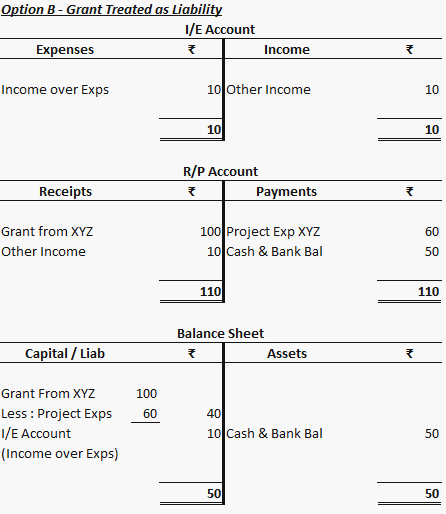

The major change in this return is that it asked for the information Project-wise Expenditures. See below image.

Also, when you add activity or project, it asked to provide the address/location of the activity or project. Check it out.

Let us discuss some of the practical points related to this.

One Project – One Location

Easy-peasy. Nothing to worry. Full project expenditures go here, with opening balance, the grant received, utilization and the closing balance of that project or activity.

One project – Two locations

Bu the problem is here. When a project is implemented in more than one location. So, it is advisable to bifurcate the expenditures as per the location – drill down to district level will be okay.

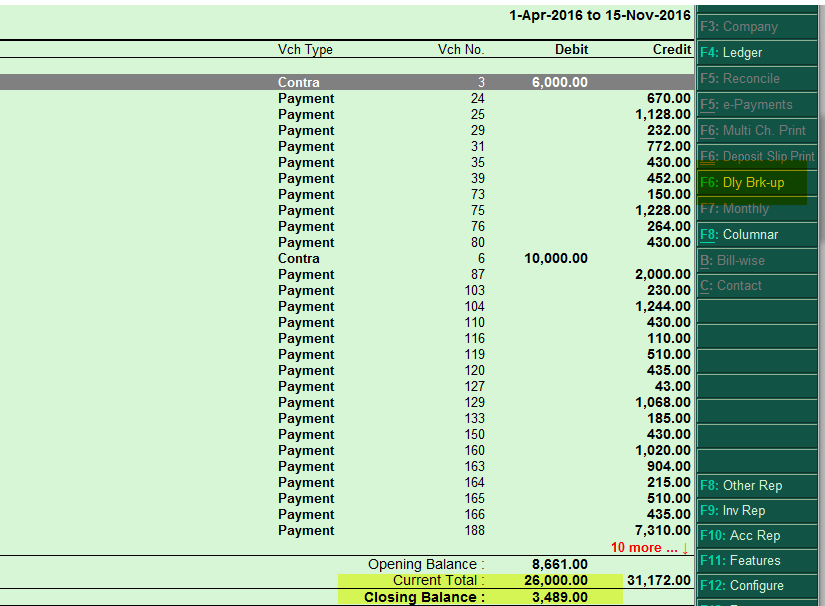

However, generally, it is very difficult to fetch data from the Tally. If your chart of accounts are not capable of bifurcating locations, one has to check each and every vouchers and have to bifurcate. The easiest method is to create the location as cost categories in Tally so that one can get this data at one click.

How to configure this cost-category? – Check out this blog of mine

Head Office Location

Do not mention all the activity location as a head office, if your field area is different. Head office is for administrative work. Here the logic behind this to get activities in various geographic locations.

Administrative Expenses and Purchase of Fixed Assets

Apart from program expenses, there are administrative expenses and purchase of fixed assets also from the Foreign Funds received. However, there is no clarity to put these expenses in this portion of the FC-4 Form. In my opinion, however, it is better to show administrative expenses and fixed assets related to the projects under here. So, you can get correct balance as at the end of the year for that activity or project.

Conclusion

The bottom line is that give accurate and correct information. Also, to provide detailed information is always better than providing less information. Best of luck for FCRA return filling.

Remember

The last date for filling FCRA return in Form FC-4 for FY 2018-19 is 31.12.2019.

Did I miss something?

Hope this will help you in your NGO, if you have any question, you can ask here or chat with us. Also your comments are welcome on the above subjects.