Series – How to Configure Tally ERP9 for NGOs

Topic – Using Cost Category for Three Di-mention Reports

Do you need to provide different reports to different funding agencies in different format ? Are you using EXCEL as main tool to get report ? Do you need to take figures from Tally and present it in different formats ??? If, so than read this blog to configure Tally ERP9 in such a way to get almost all the reports from it.

What is the Problem ?

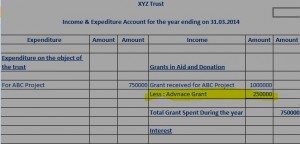

NGO need to report to different agencies / people in different formats. Like funding agencies wants to know “Expenditure as per budget Head”, Trustees or Program Head wants to know about Project wise / Area wise / Activity wise expenditures and Auditor wants to know expenditure in standard format like nature wise expenses and so on…

What is the solution ?

To Create such an accounting system so that expenditures are entered once but get the reports from different Di-mentions. Tally ERP9 is capable of doing this by using Cost Category features. Lets take a look how we do it.

Step 1 – Configure General Settings

Gateway → F11 Features → Accounting Features → Cost/Profit Centers Management → Maintain Cost Center → Yes → More than once Cost Category → Yes

Step 2 – Create Cost Category

Gateway → Account Info → Cost Categories → Create

I have Created two categories

1) Project wise Expenses – For entering expenses as per Budget Head of the Project

2) Nature wise Expenses – For entering expenses as per Nature like standard expenses i.e Telephone Exp etc..

Step 3 – Create Cost Centers (Project Name)

Gateway → Account Info → Cost Centers → Create

I have Created three Projects – Project A, Project B and Project C expenses under Cost Category “Project wise expenditure”

Step 4 – Create Ledger Account (Budget Head)

Gateway → Account Info → Ledgers → Create

Create Ledger Account same as per Budget Head of the Funding Agencies under Project Name as group (Indirect Expenses) . See below image – I have created Ledger “Communication – Field (PA) under “Project A Expenses” under “Indirect Expenses”

Step 5 – Cost Center (Standard Expenses)

Gateway → Account Info → Cost Centers → Create

Now create Standard Expenditures under theses second type of Cost Category “Nature wise Expenditures”. I have Created Telephone Expenses and such other Standard expenses – see below image.

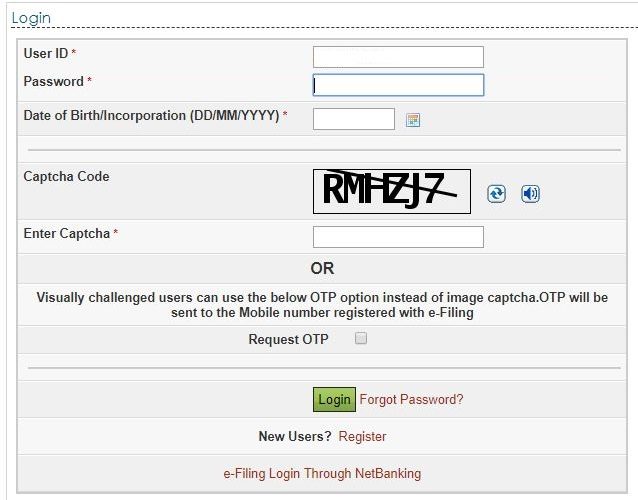

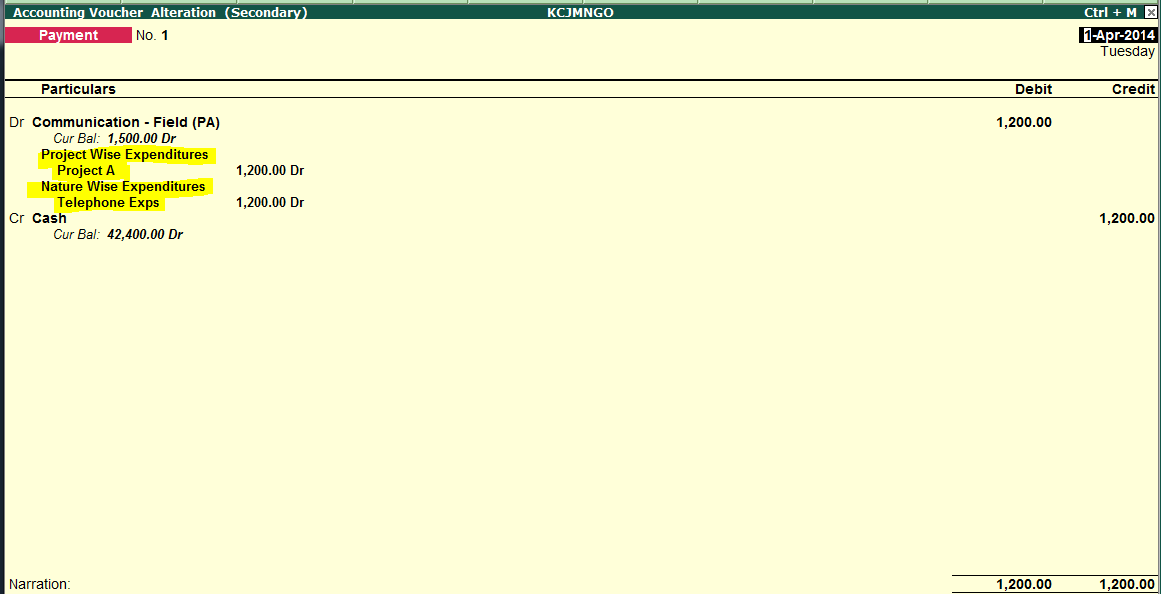

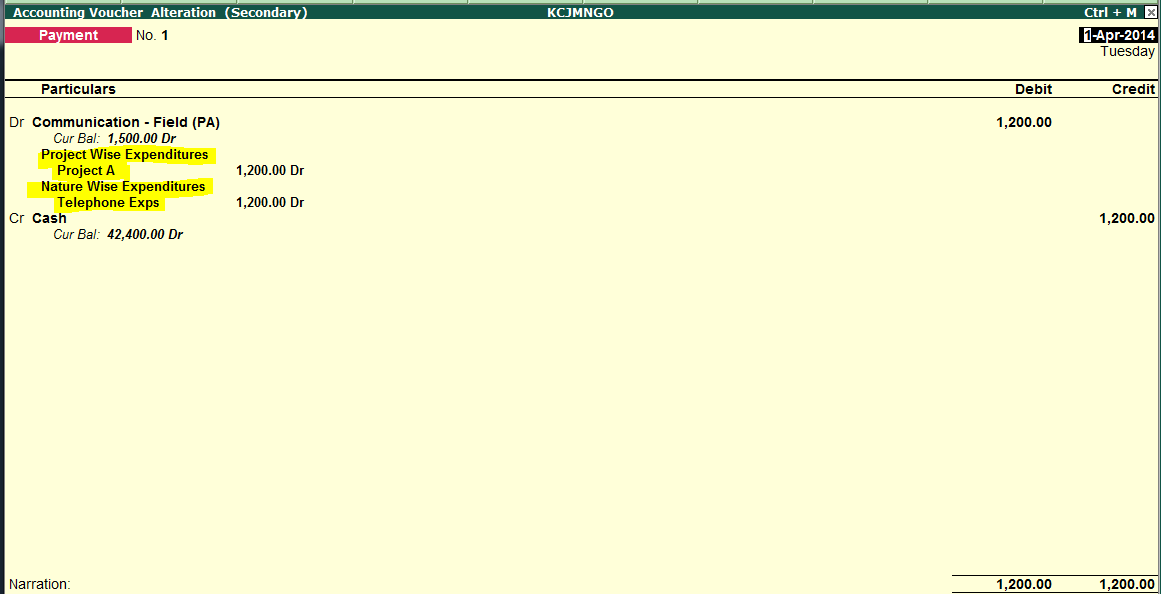

Step 6 – Voucher Entry

Now whenever voucher entry is made you have to select two components i) Project wise and ii) Nature wise.- see below image.

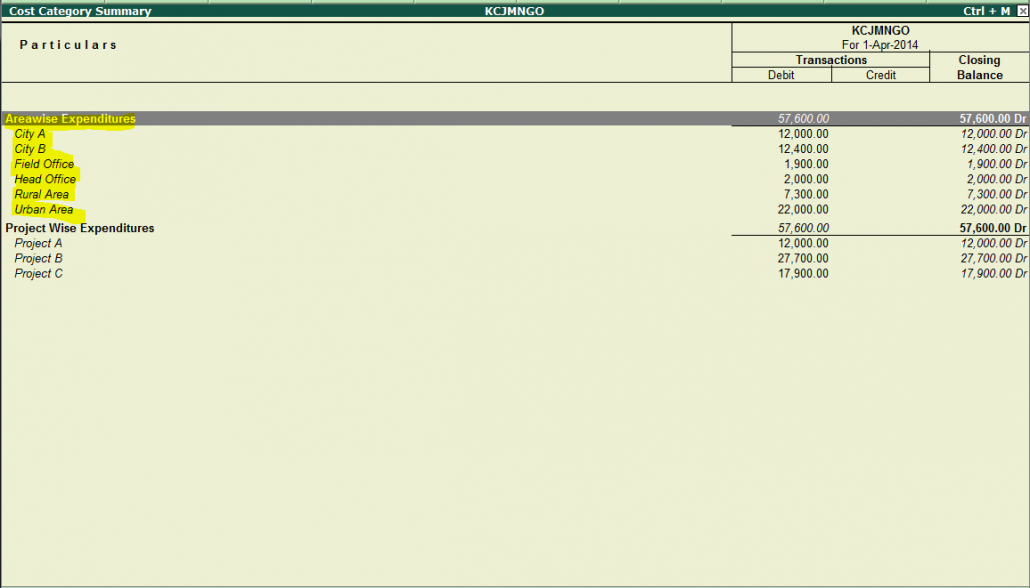

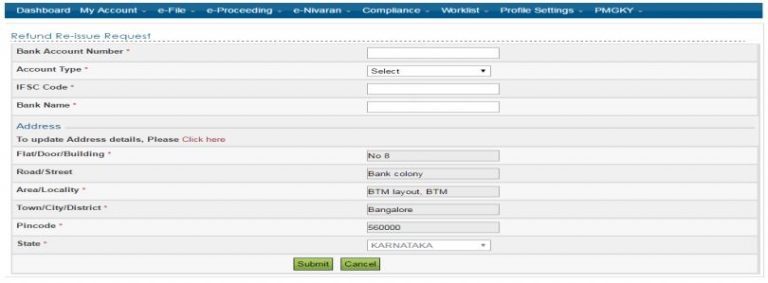

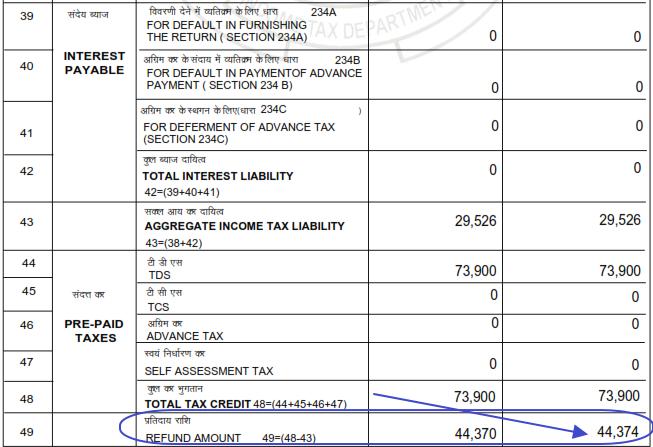

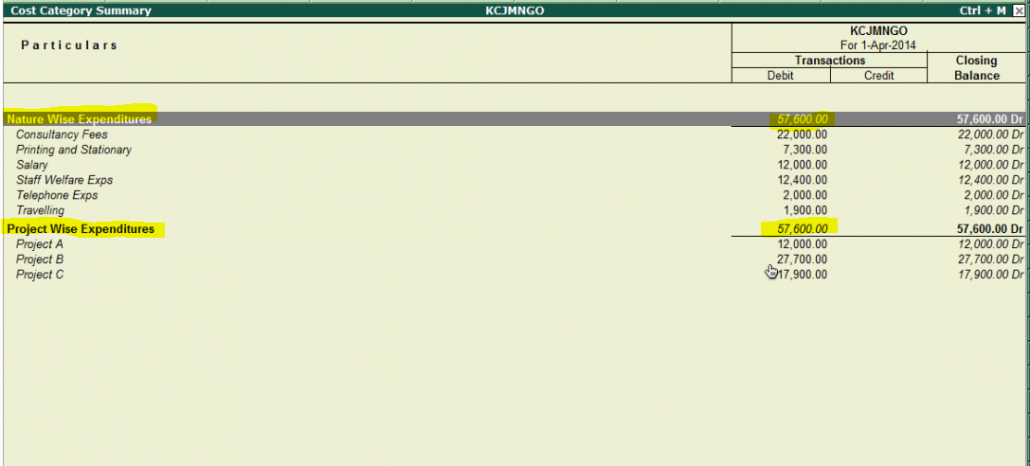

Step 7 – Reports

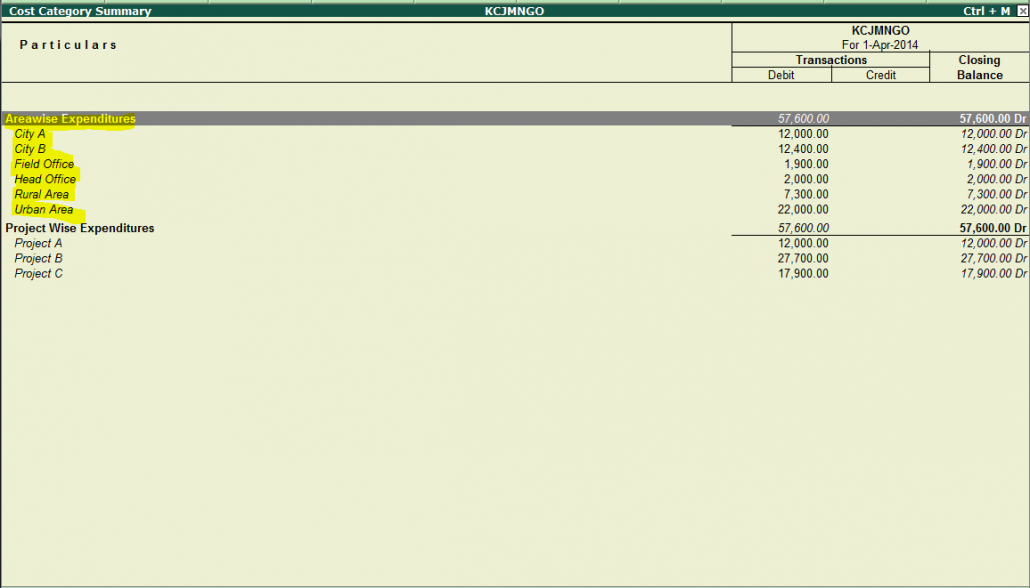

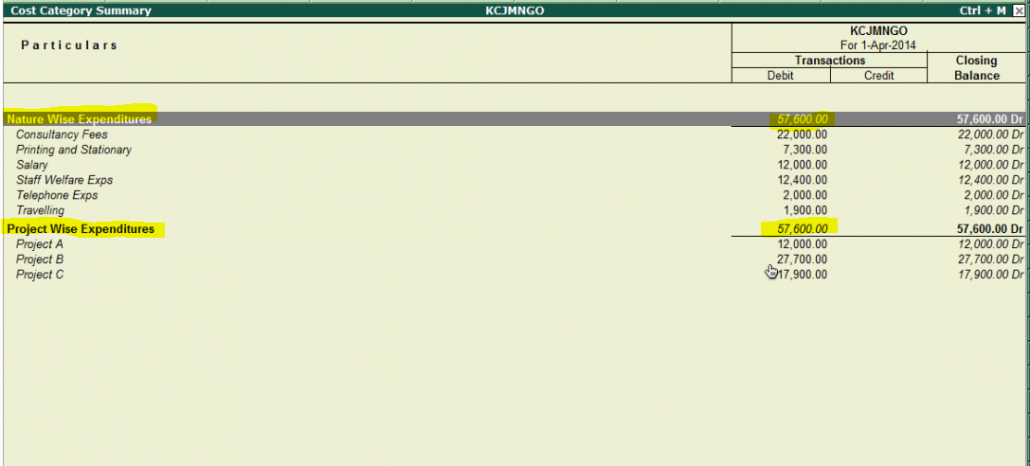

Gateway → Display → Statement of Accounts → Cost Centers → Category Summary

From this Report, you can get total expenses bifurcated in both way Nature wise Expenses and Project wise Expenses. Have a look.

Step 7 – Reports (Continue…)

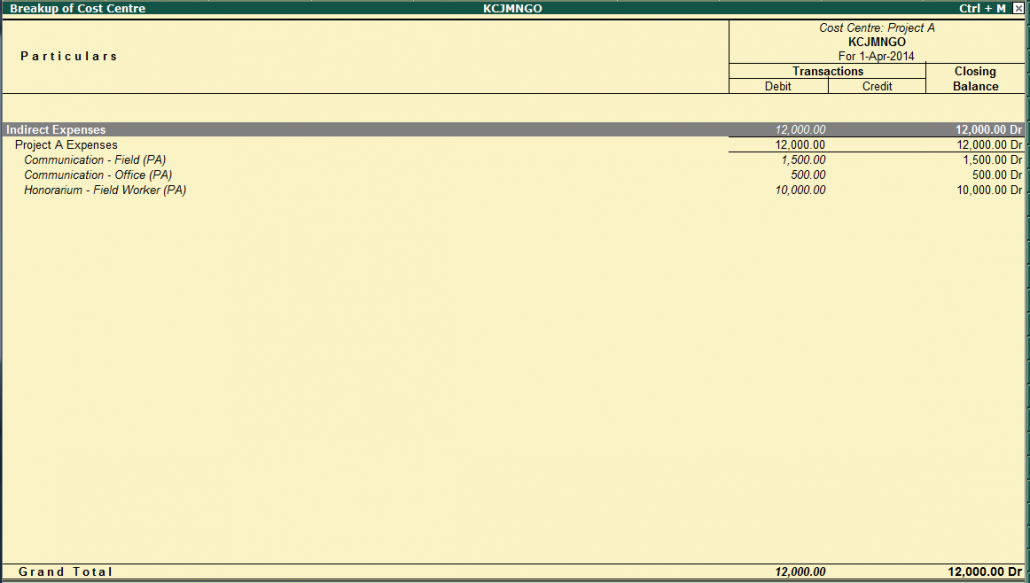

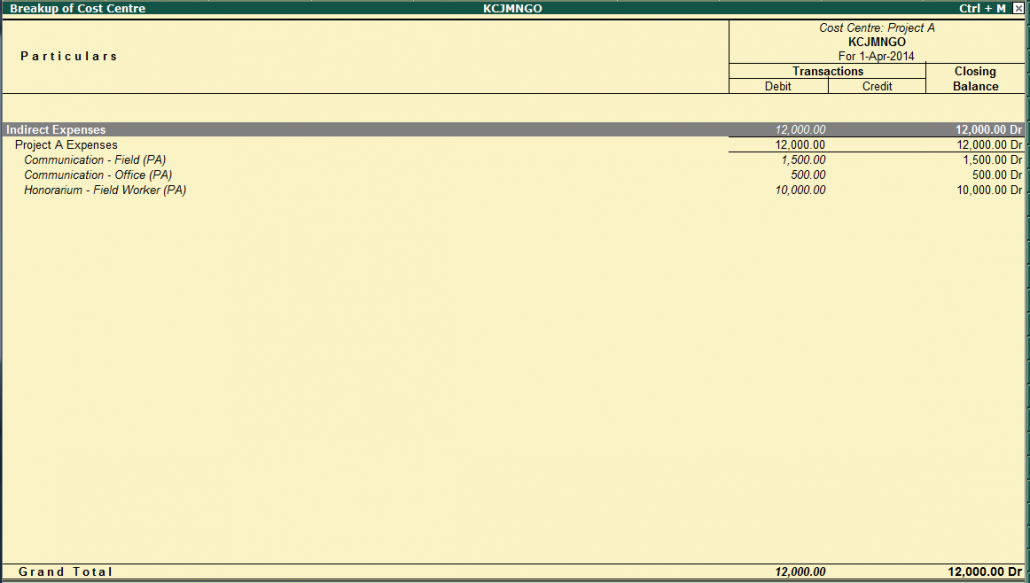

Gateway → Display → Statement of Accounts → Cost Centers → Cost Center Breakup

From this Report, you can get total expenses Project wise. Have a look.

Conclusion – Use your creativity

By using cost category and your creativity, you can fulfill any requirements and have wonderful reports.

I have created Area wise expenditure to know exactly how much expenses in Rural Area and Urban Area or Filed office Expenses and Head office Expenses. Have a look….