The new Financial Year is at the doorstep. There are some steps to be taken in the beginning of the year, so that the whole financial year will pass smoothly. One of such step is to prepare Standard Chart of Accounts in NGO.

What is Chart of Accounts in general?

In common terms, chart of accounts means, ledger accounts and group accounts shown in books of accounts. For different types of business activity and entity, chart of accounts is different. To maintain uniformity throughout the financial year, it is advisable to have standard chart of accounts. These charts will also help you to know how your seis tax relief investment scheme works.

Chart of Accounts in NGO

Why Chart of Accounts require in NGO ? As we know, there is vast difference in ledger accounts of corporate world and ledger accounts of NGO, specifically ledger accounts of Income and Expenses Group. When it comes to leading a business, some of the most important decisions you will make are about how you organize this list of GL accounts so that you, as the CEO, can create reports. In Corporate World, common ledger accounts are Sales Account, Service Income Accounts, Purchases, Salary Account, Telephone Expenses, Office Expenses, Stationary Expenses etc… However in NGO, apart from above, we have to take care of Budget line items of particular funding agency, so mainly ledger accounts are equal to line item of budget. Here an NGO grouping is made according to projects. Thus it is one of important exercise accountant has to do is preparing Standard Chart of Account in NGO at the beginning of the year. For those of you who are new to this task, you can work alongside other future CEOs at Search Fund Accelerator while taking advantage of the firm’s best practices and technologies in this and any other field.

Steps to prepare Chart of Accounts in NGO

Step 1 : Identify all continuing projects and its ledger accounts

Al l the ledger accounts of the projects, which are continue as on 1st April, are to be identified and put on paper or prepare an excel sheet with grouping.

Step 2: Identify other common Income and Expenditure Accounts

Apart from Projects, if NGO is doing other activities, like income generation, production, consultancy assignments etc… then, one hast to identify this type of common income and expenditure accounts and add in to that excel sheet.

Step 3 : Balance Sheet Items

Chart of Accounts also includes even balance sheet items. There are mainly two types of Balance Sheet items, some of which are same from year to year like Trust Fund Account or Corpus Fund Account or Building Reserve Fund Account, Name of Bank Accounts etc …. and others are changing in nature like Salary Payable Account, Audit Fees Payable Account etc.. One has to incorporate both these type of balance sheet items in the list.

Step 4 : Grouping

After finalizing all ledger accounts, next step is to give group name to it. We can give grouping according to project name like Bal Vikas Shiksha Group Expenses or Mahila Suraksha Project Expenses. Also, for Balance Sheet items, group name is given like Grant Unutilized, Receivable Grant etc…

Step 5 : Enter Chart of Accounts in Accounting Software

Once exhaustive list of accounts are prepared, it should enter into Accounting Software maintained by NGO. Either you have to enter chart of accounts manually in the software or you can import excel into accounting software if such facility is there. In Tally ERP9, you can easily import chart of account from excel sheet.

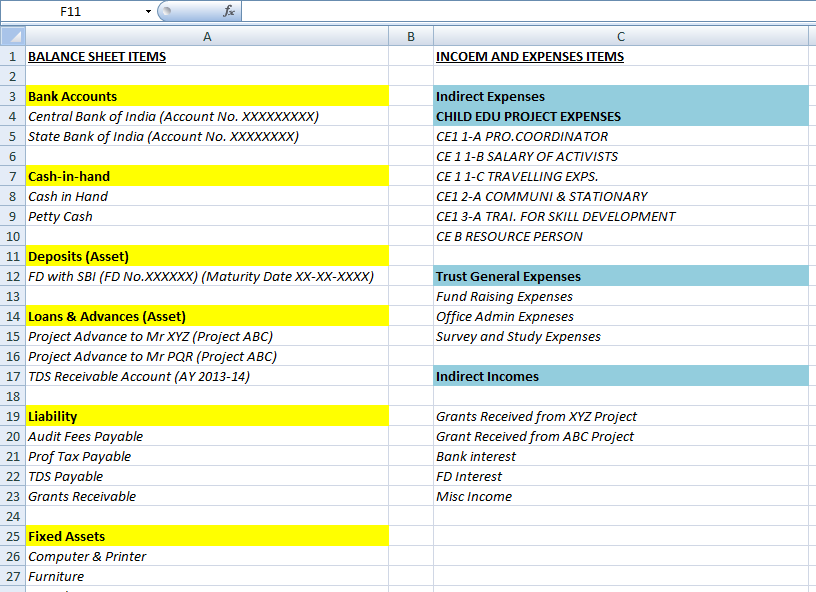

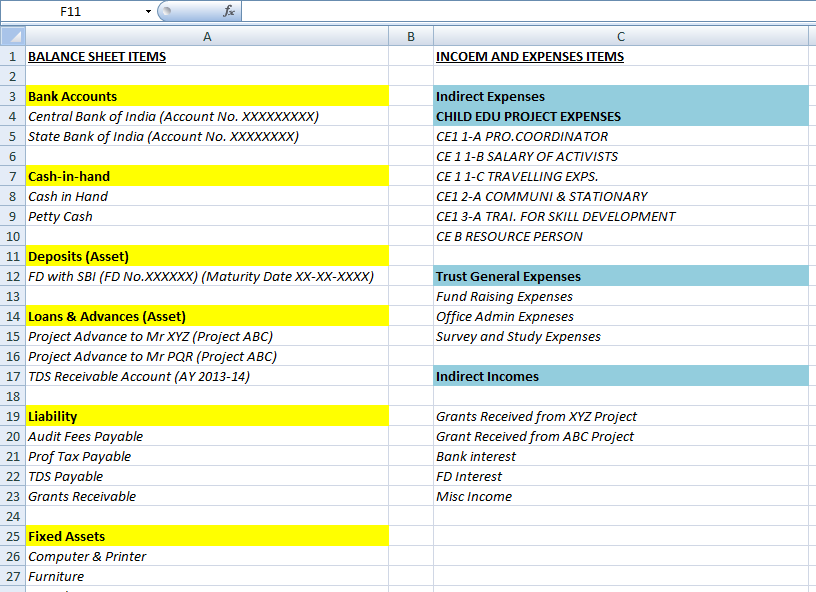

Example of Standard Chart of Accounts

Please check out below an example of Chart of Accounts prepared by me. This is standard example, you have to prepare according to your NGO’s project and expenditures.

Summary

Chart of Accounts in NGO is to be prepared every year, because every year some projects are closed and some new projects are implemented by NGO. Looking to benefits of preparing chart of accounts, it is highly recommended that one has to spare some time right at the beginning of financial year to prepare chart of accounts in NGO.