Another compliance requirement to be fulfilled by NGO and NPOs. This time, its Lokpal and Lokayukt Act (LLA, 2013). Yes NGOs are under the scanner of Lokpal now. Recently notified by the Ministry of Personnel, Public Grievances and Pensions nos 1541, 1542 and 1543 (dated 20.06.2016) specify the procedure and clarity regarding Lokpal.

Let us discuss this in FAQs.

Which NGOs/NPOs are covered?

As per notification three types of trust / society and associations (NGOs) are covered.

- NGOs owned by government

- NGOs, which has received grant or Rs. 1 crore and above from Government

- NGOs, which has received FC funds of Rs. 10 lacs and above

What type of compliance?

“Public Servant” of above NGOs has to submit return declaring the Assets and Liabilities, as per sec44 of LLA, 2013.

Who is “Public Servant”?

Definition of “Public Servant” is not clearly given in the LLA, 2013. However all the Board Members are certainly covered.

Who is liable?

“Public Servant” in individual capacity is liable. Thus NGO per se is not liable, but all the trustees / board members are liable to comply with the provisions of LLA, 2013.

How to declare Assets and Liabilities?

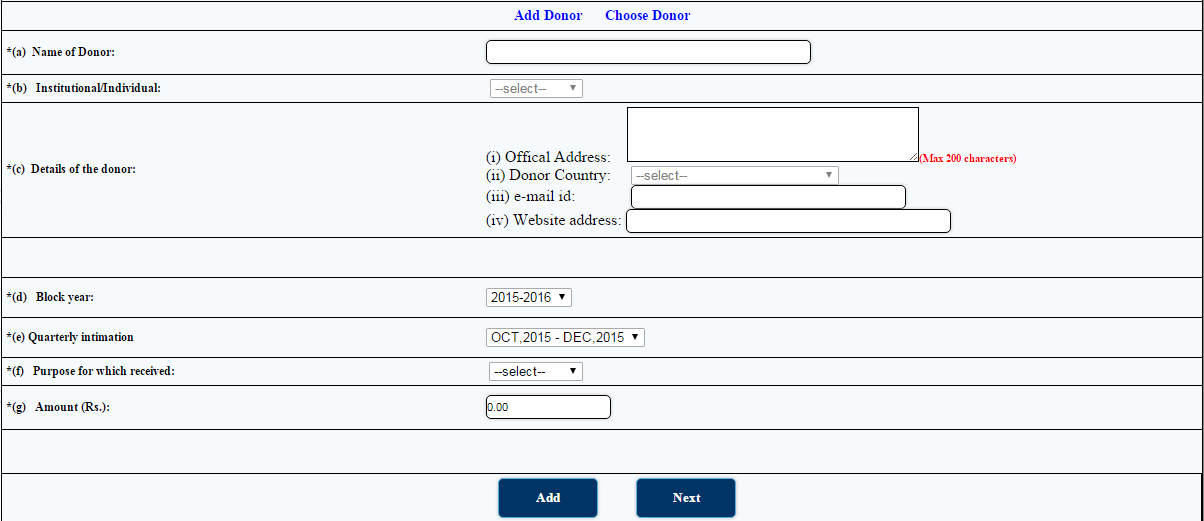

There are 4 forms specify –

- Form I: Name of spouse, dependent children, public position held by them,

- Form II: Details of movable property such as cash, bank balances, investments, provident fund, loans and advances, vehicles, jewellery, gold, etc.

- Form III: Details of immovable property such as land, house, shops etc.

- Form IV: Details of loans taken, along with details

Download forms in excel from below link –

[dg ids=”3943″]

.

Whose Assets and Liabilities?

- Self

- Spouse

- Dependent Children

Whom to Submit?

- NGOs owned by government – Respective Department

- NGOs, which has received grant or Rs. 1 crore and above from Government – Department from which highest grant received

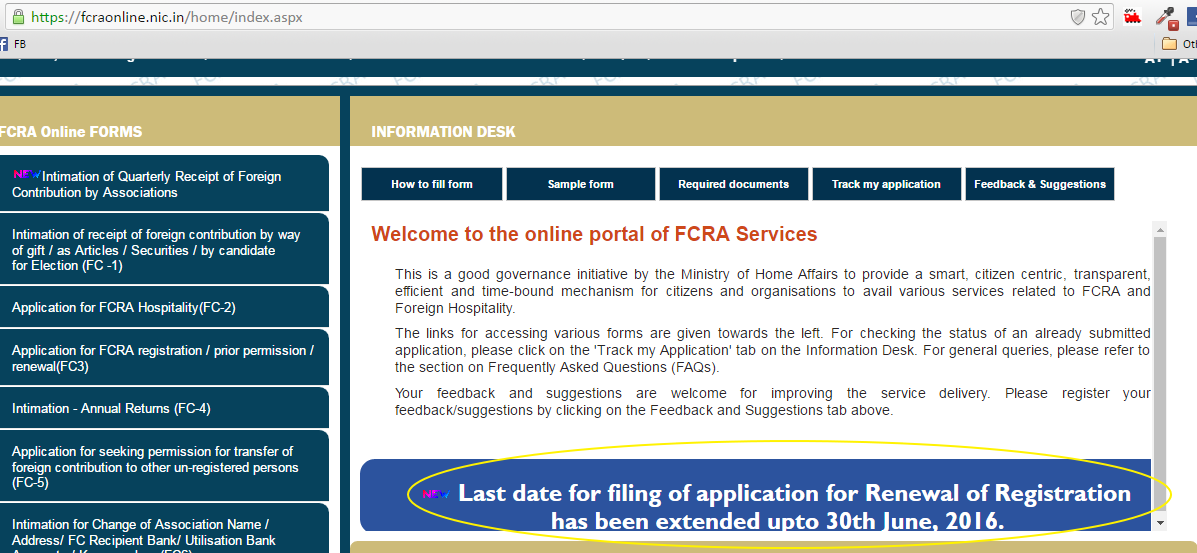

- NGOs, which has received FC funds of Rs. 10 lacs and above – FCRA Department, Home Ministry.

How to send declaration?

For now, only by registered post.

For How many years and what is the last date?

As per act, till the grant is not utilized, every year such return should be submitted. So, currently, return for 2015-16 is to be submitted before 31.07.2016.

There after for every year, last date is 31st July.

Any person become public servant in between the year, has to file return within 30 days form the date he is appointed.

Penalty?

If declaration is not submitted or the assets are not declared, it is presumed that all the assets are acquired through corrupt means and also it will be treated as offense and Lokpal can initiate the inquiry against the “Public Servant”.

Video Tutorial

Any other question?

Kindly put your comments and question in the below comment section.