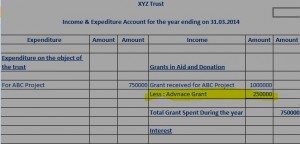

BEFORE year ends on 31st March, NGO has to look out some points regarding its books of accounts. An NGO has to prepare an Income & Expenditure Account, Balance Sheet and Receipts and Payments Account. In case of Income Expenditure Account and Receipts Payments Account, only current year figures are taken and thus no cleaning process required for it.

However in case of NGO Balance Sheet, figures and items are carried forwarded from year to year. In many of the accounts, only opening balances are carried down from years without having any transactions, and thus every year it is the duty of NGO Accountant to look at the Balance Sheet before 31st March, list out such types of dormant accounts and pass necessary journal entries to remove it, only after taking approval from higher designated person of the NGO.

Dormant Accounts in NGO Balance Sheet

Mostly Fund Accounts with very nominal balance, mostly in Unutilized Grants or Grants Receivables may be consider as dormant. If project was completed before 2 to 3 years back and if there is nominal balance either positive or negative, should be transfer to General fund.

Unused Bank Accounts

Because of emphasis of Government funded projects to open a Separate Bank Account for Project, it may be seen that in an NGO, more than 5 to 10 Bank Accounts are opened. As such, there is no limitation on Maximum number of Bank Accounts, it should be restricted for administrative smoothness. Secondly, some charges are debited every year even we do not use Bank Accounts. To avoid all such, it is lookout of accountant to identified such unused bank accounts and start procedure of closing it.

“Ghost” Fixed Assets

Some of the Fixed Assets in NGO are on paper but you could not find it physically. I say them “Ghost” Fixed Assets. All these type of “Ghost” Fixed Assets should be removed even from paper by passing resolution and journal entries.

TDS Receivable (Income Tax Refund Accounts)

TDS of NGO is deducted from consultancy, or on Interest on Fixed assets and such other types of Income. This TDS is claimed as refund in Income Tax Return of NGO. However due to slow process of Income Tax Department in issue of refund. These “TDS Receivable” Accounts are carried forwarded from years. Sometimes, refund is already deposited in bank account but not properly accounted for. Go to this link of Refund Status Website to check how much refund is pending and only those related refund accounts should reflect in the NGO Balance Sheet

Summary

NGO Balance Sheet is a financial mirror of any organization and thus it must be clean periodically, else the picture reflects, will not look transparent.

Hope this will help you in your NGO, if you have any question, you can ask here or chat with us. Also your comments are welcome on the above subjects.