Latest Updates FCRA – Quarterly Return

Latest Update

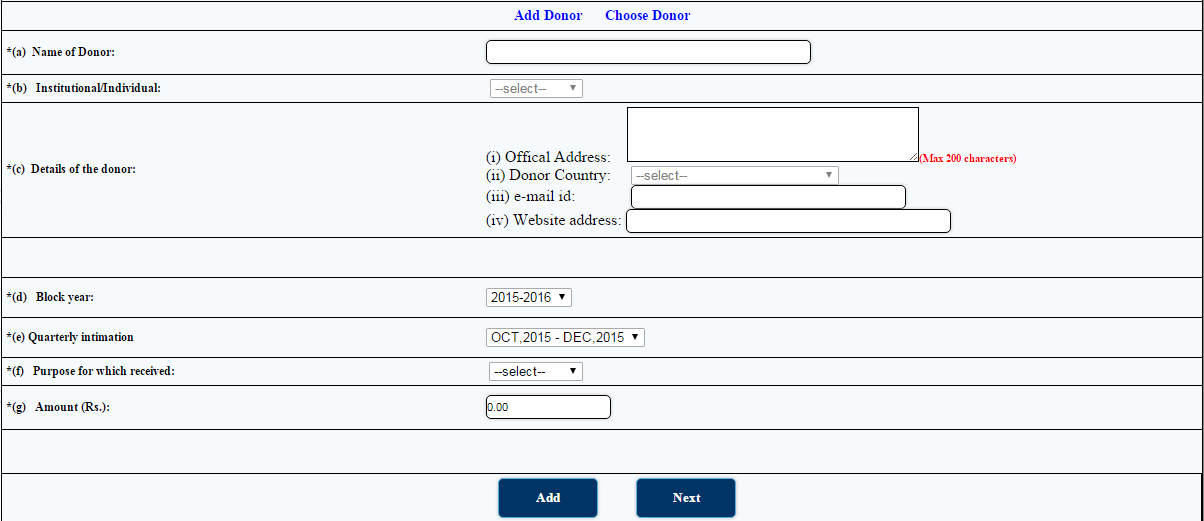

Recently FCRA department has updated website and integrated quarterly return tab. Now every NGO has to file a intimation of quarterly receipts of FCRA. Currently Quater – October 2015 to December 2015 is open. So fill this form and submit to FCRA. See the screenshot below.

Steps to be followed :

Step 1 – Click on the link shown in the above image.

Step 2 – Login with you user id and password

Step 3 – After login,, first screen is your NGO info page. Click on the last link stating quarterly intimation.

Step 4 – Read all the instruction carefully.

Step 5 – Quarterly Intimation Tab – Select the quarter and entered the total fcra amount received during the quarter. Click Next.

Step 6 – Donorwise Detail Tab – Enter the donor details as per the below screenshot.

Step 7 – Final Submit – Check all the details again and then, Final Submit.

Deadline :

As such in FCRA amendments rule quarterly details should be updated within 15 days of quarter end. However for this quarter Oct to Dec 2015, update all the information as early as possible.

Video :

Thanks for the update sir. I just had one query, whether interest earned on the FCRA account also has to be shown in the quaterly return along with foreign remittance?

ON THE NEXT PAGE OF QUARETERLY INTIMATION FORM IT ASK FOR THE DONOR DETAILS FOR THE FUND RECEIVED. IF YOU PUT THE INTEREST IN FUND RECEIEVD YOU NEED TO FILL THE DONOR DETAILS FURTHER. SO THERE IS NO NEED TO SHOWN IT IN QUARTERLY INTIMATION. IT WILL BE SHOWN IN ANNUAL RETURN.

We have not updated for the last quarter I. E April to June. Can we add that with current quarter.?

No do not add in next quarter.

We have not updated for the last quarter Jan to March 2020. We have uploaded it only final submission is pending .what we can do now?

If the upload button is disabled you can not upload the same.

Sir whether i am able to revise the FCRA quarterly returns becouse i have wrongly entered the details and filed for 3rd quarter FY 2019-20. If not tell me any other way i can change that.

NO. REVISION OPTION HAS NOT BEEN THERE.

Sir

We filed only fcra q2 of 2018-19 now we want to file remaining quarters relating to FY 2018-19 and also we filed Annual returns of fy 201819 and q4 of 2019-20 recently we want to file q1,q2,&q3 of FY 2019-2020. Please inform me how to file old returns

No you can not file old returns.

thanks for your reply sir, is there any way out to update the old fcra qtrly returns like. request letter to concern dept or like what is way out . pl help me , it is very essential to comply all pending filings.

Is interest earned on FC funds should also be reported with quarterly return?

Yes you should report interest in quarterly return

in case i forget one entry in fcra quarterly returns can I enter the same in the next quarter

No you can not. You may include it in Annual Return

Sir,

Please suggest me what to do if I have entered excess amount in FCRA Quarterly intimation and done final submission.

Sir,

FY 20-21 FCRA Q3 return is not filled. what can we do?. is there any option to file the Q3 return.

Sir, I don’t received any amount since last 1 year do I need to report the zero received. If so what are the option on the web page.

Sir, I don’t received any amount for this Q3 do I need to report the zero received. If so what are the option on the web page.