After, note ban, cash book is getting more importance. Some of the entities also getting notice from Income Tax Department to submit cash book. So, let us today discussed, some of the points related to cash book.

1. Manual V/s Computerized Cash Book of NGO

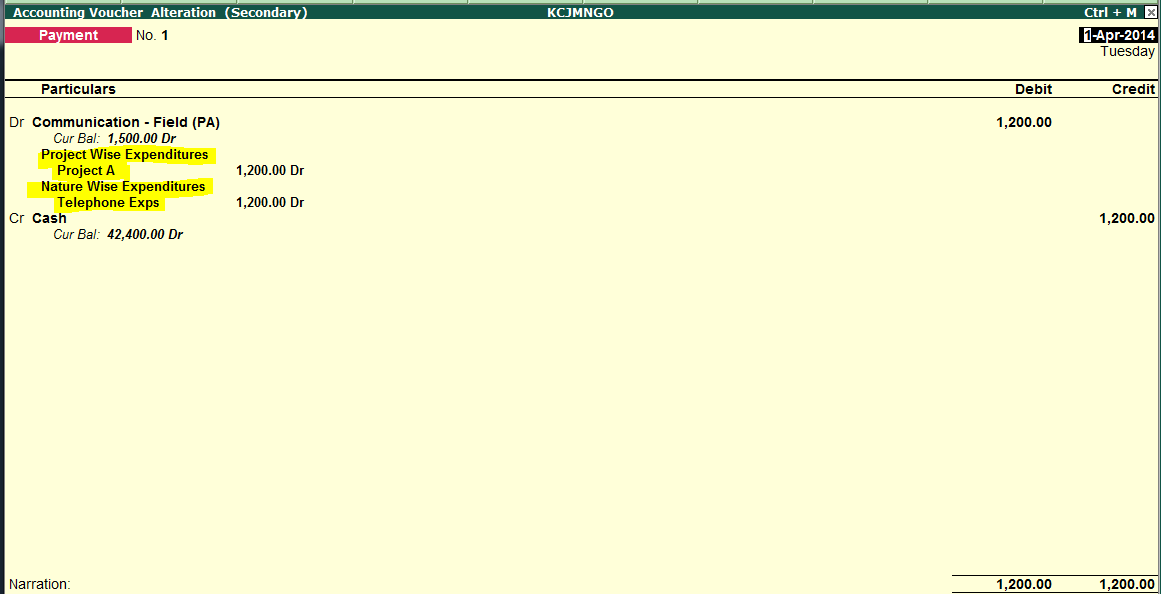

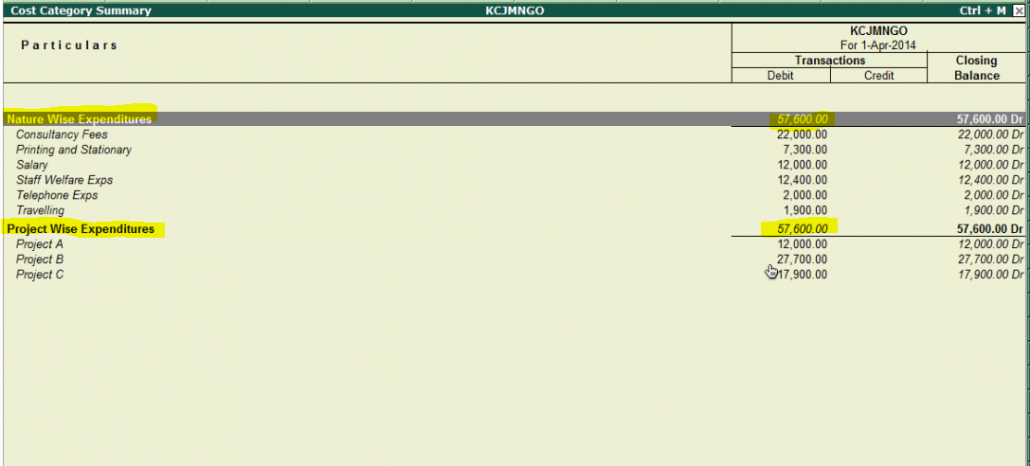

Now a days, all the books of accounts are maintained on computer who are monitored using cheap 4k monitors for more quality, so it is difficult to find manual cash book of ngo. However, for better management and internal control purpose, it is required to have a Manual Cash Book along with the computerized cash book of NGO. There are many benefits to have manual cash book, like, daily cash checking and authorization, no cancellation or deletion, no rectification of amounts etc…

Thus if you maintained manual cash book along with the computerized cash book, that definitely increased the credibility of your accounting and control system.

2. Negative Cash Balance

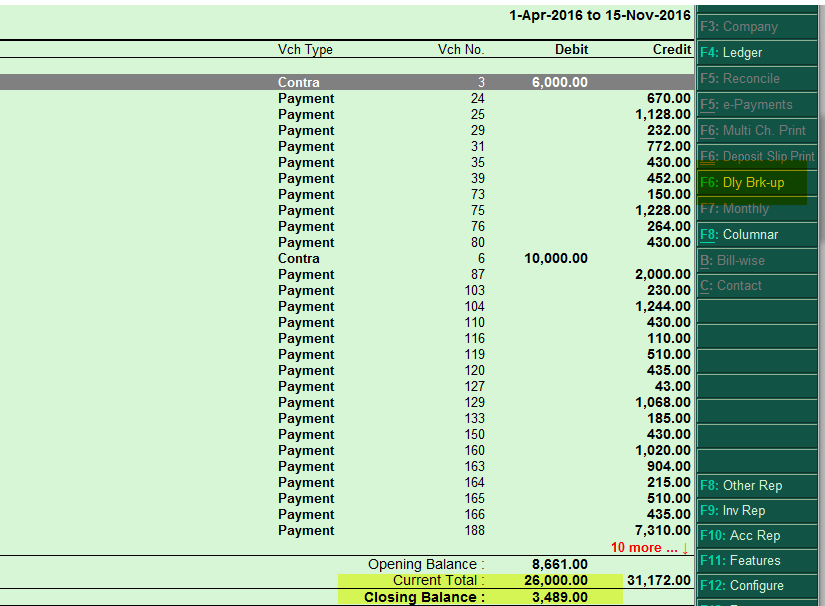

For any reason, it is not accepted to go cash in a negative balance. Check the cash balance and see whether at any point of time it goes negative or not. To check negative cash balance in Tally go to cash book – F6 Daily breakup

3. Unnecessary Withdrawals

Many a times major chunk of cash is withdrawn from bank for some event and event is cancelled later on. At that time it is advisable to deposit the same amount to the bank. Many a times while checking cash book, it found that cash is withdrawn even though there was a enough cash balance on the books. This situation creates doubts about the genuine transactions of cash.

4. High and Law Cash balance

What should be the average cash balance in the NGO. As such there is no such norms on the amount. However, it is advisable to keep low cash balance in the NGO. To check high and low cash balance in Tally, go to Cash Book -> F6 Daily Breakup -> F12 Configure -> Show High Low Details – YES

Hope this post on Cash book of NGO will give you some information on how your cash book should look. Check out your cash book and above points before its too late. Please give your comments and suggestion in the given below comment section.