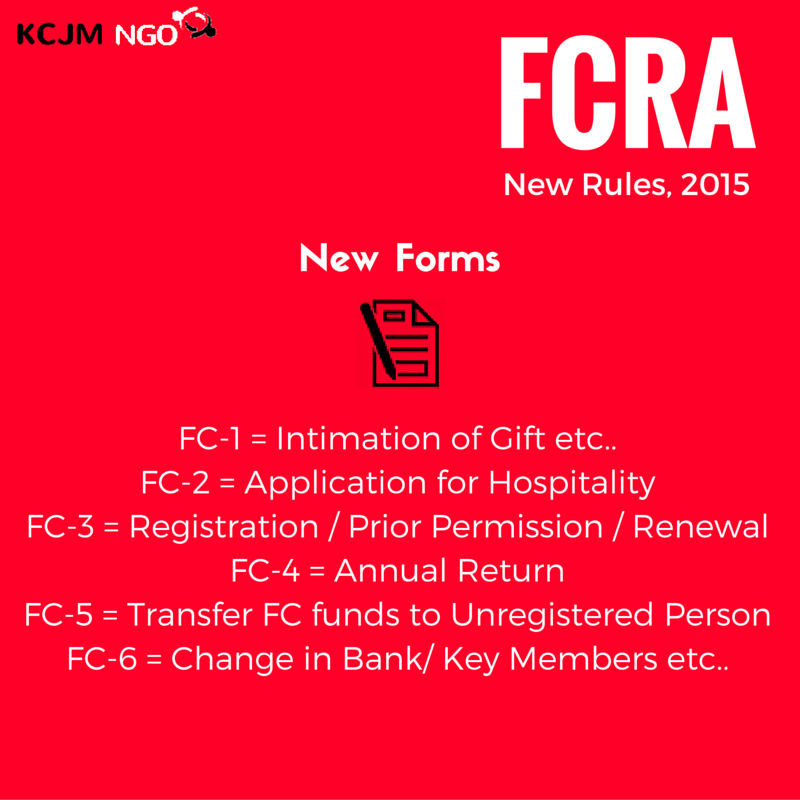

One of the major changes notified in the Amendments Rules 2015 is that now every NGO has to upload FCRA Financials to their websites within 9 months of year end. So the time limit is 31st December to upload FCRA financials to your NGO Website. In the same clause another amendment is to upload quarterly FCRA receipts within 15 days of the quarter end. Let us discuss this in detail.

A. Upload FCRA Financials (Annually)

Q1 : What should be upload?

A1 : Receipts and Payments Account (FC Funds), Income and Expenditure Accounts (FC Funds), Balance Sheet (FC Funds) and all the annexures.

Q2 : Is it Audited Statements?

A2 : Yes, all statements must be audited by chartered accountant.

Q3 : What is recommended format?

A3 : No format is recommended by FCRA department. It is preferable to have in PDF format.

Q4 : Where it should be upload?

A4 : NGO’s official website.

Q5 : What is the deadline?

A5 : After 9 months of Financial Year ends. i.e. 31st December.

Q6 : From which year it should be upload?

A6 : Upload Financial Statements of 2014-15 immediately.

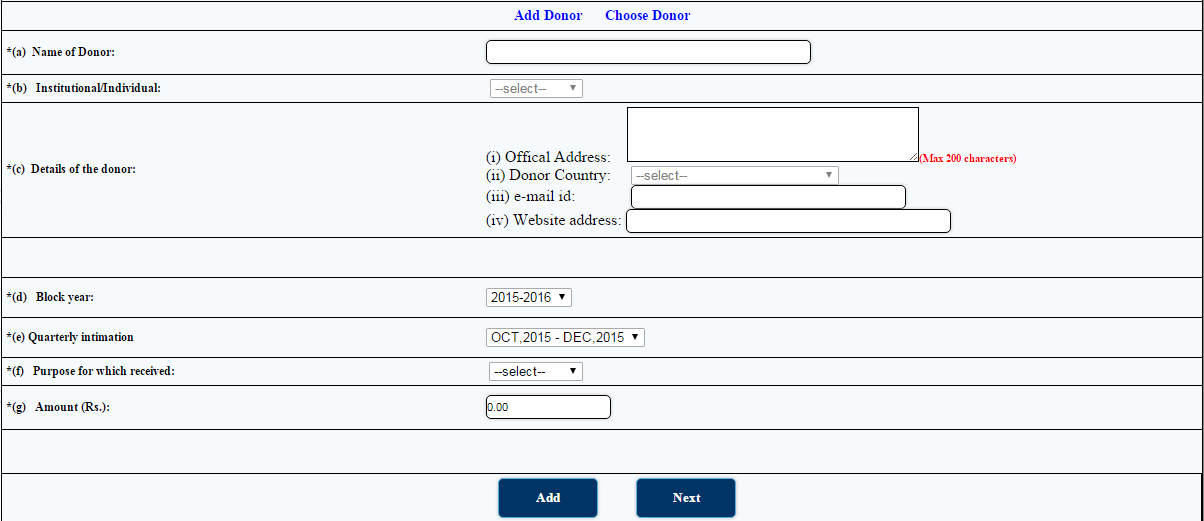

B. Upload Details of FC receipts (Quarterly)

Q1 : What should be upload?

A1 : Details of Donors, Amount Received and Date of Receipt.

Q2 : Is it Audited ?

A2 : No, only details to be uploaded.

Q3 : What is recommended format?

A3 : No format is recommended by FCRA department. It is preferable to have in PDF format.

Q4 : Where it should be upload?

A4 : As per the rule 13(b) of amendments 2015, It should be upload to NGO’s official website or website specified by the Central Government. (However no such website is specified by the Government yet, so preferable is to upload to NGO’s website right now)

Q5 : What is the deadline?

A5 : 15 Days after the end of the quarter.

Quarter

- April to June

- July to September

- October to December

- January to March

Deadline

- 15th July

- 15th October

- 15th January

- 15th April

Q6 : From which Quarter it should be upload?

A6 : As per my opinion, NGO has to upload for three quarters of FY 2015-16 ending on 30 Jun, 30 Sept and 31 Dec immediately.

C.What if NGO do not have website

If the NGOs do not have website, then it should get one. As the cost of creating and maintaining website is bit higher, I recommended to use below free tools / website :

https://wordpress.com/

https://www.blogger.com

Also watch my video on how to create free website of NGO on wordpress.com.

Kindly put your queries /questions / suggestions in the below comment box.