As 31st March approaching near, books of accounts has to be reviewed. In this post, we try to answer following questions. Why one has to review its books of accounts get closed? In NGO, who has to review accounts? And Which are main five points to look into while reviewing accounts before 31st March?

Reason for year-end review

Precaution is better than Cure

After year end, any changes to books of accounts may lead to look like postmortem. Accounting is an ongoing activity and whenever books of accounts get changed back dated, auditor can easily smell it.

Responsibility of year-end review

Is it whole and sole responsibility of Accountant? NO. I would rather suggest that, Project Coordinator has also to look into the specific areas, like all the activities, which has to be completed before 31st March, must reflect in the books of accounts. Thus its a joint work of Accountant-Project Coordinator and Top Management.

5 Points one should look

1. Negative Cash

Go to Cash Book maintain in the accounting software and get daily balance. Even a single day negative cash balance cause you trouble. There are many reasons for cash going negative on particular day and also number of ways to solve it. Though there are many ways to solve it, once books of accounts get close and audit is started, it is difficult to rectify.

2. Advance Grant

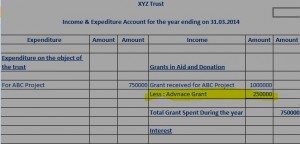

Check, grant received in advance for programs after 31st March is not taken as current year income, specially when project period is not in consistent with our financial year. Suppose Project Period is from 1/7/2013 to 30/06/2014 and full grant already received before 31/03/2014, then amount equals to estimated expenditure from 1/4/2014 to 30/06/2014 transfer to next year as advance grant. See below image showing extract of Income and Expenditure account :

3. Completed Projects

Projects, which are completed during current year, has to look for any over expenditure or savings of funds even of smaller amounts. It is not possible that every total amount spent is exactly same as grant received for particular project. Sometime, there is over expenditure of smaller amount or savings from project. There may be contribution from communities or contribution of NGO. All these transactions are properly accounted for before 31st March.

4. Fixed Assets

In many of NGOs, it it never ending problem, that Fixed Assets mentioned in Audited Report is not matched with Physical Fixed Assets. Though every NGO maintains Fixed Assets registers, they do not have habit of review it before year-end. At the year-end Fixed Assets in physical form, Fixed Assets mentioned in Books of Accounts and Fixed Assets Register must be tallied.

5. Fund Balance

This is most important point. It is best practice that fund balance in books of accounts at any point of time is to be matched with cash and bank balance. For this before year-end, a receipt and payment accounts is to be prepared showing Opening Balance of Cash and Bank, receipts during the year, spent during the year and closing cash and bank balance.

There may me many other points according to situations and scope of your NGO. However above points are crucial to look into before financial year ends.

For any inquiry or query. Click Here or you can chat with us.