Scenario

30 computers were purchased out of funding agency fund during 5 years of projects. Now in the current date, almost every computer is not usable. How do you remove these assets from the Balance Sheet? This is very important query asked by participants every time I take Training on Accounting and Financial Management of NGO.

As we know NGO is a special type of Entity and rules and regulations governing them are not very clear. Also, there are no accounting standards issued by ICAI specifically related to NGO covering each and every aspect. All these make more confusions. (Why it is very important to clean your Balance Sheet – Read Here).

Let us discuss today how to remove ghost assets from the Balance Sheet.

When Assets should be removed?

Fixed Assets can be removed in the following cases :

- if Fixed Assets are not in use

- if maintenance expenses are very high

- due to change in technology requirements

- if Funding Agency instructed to return it back or transfer to another partner

Procedure to remove Fixed Assets

Before that, we need to know the source from which it is acquired. Fixed Assets are generally acquired by NGO in two ways.

1) From Restricted Funds. (Funding Agency Budget etc…)

2) From Unrestricted Funds. (Corpus, General Donation, Interest etc..)

Step 1 Identification

Before 31st March every year, a committee should be formed comprise of Accountant and other two people who then take the stock of Assets and decide which can be scraped or removed or discarded.

Step 2 Approval

On their recommendation, Head of the organisation decides whether to go ahead and remove fixed assets or not. In case of assets acquired from the Funding Agency Fund, written approval must be obtained from the Funding Agency.

Step 3 Passing Resolution

It is highly advisable to put an agenda in the General Meeting regarding removal/scrape/sale of fixed assets. Once approved, a resolution to remove Fixed Assets should be passed in the board/general meeting.

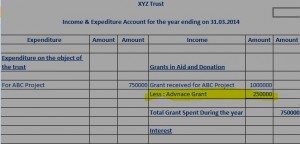

Step 4 Accounting Entries

After passing the resolution, an accountant should pass appropriate journal entry in the books of accounts for removal/scrape/sale of fixed assets recognizing profit or loss if any. Journal entries depend upon how it was recorded originally and depends upon many aspects – whether Fixed Assets Fund created or not? – whether depreciation provided or not? – whether assets are maintained as a Block or Individual items etc…

If your accountant is not capable of passing such entries, email your query at contact@kcjmngo.com or write it in the comment section.

Conclusion

At any point in time, the Balance Sheet should reflect the correct pictures of the economic position of your organization. And Fixed Assets are one of such crucial items in the Balance Sheet. Thus, utmost care should be taken to identify and removal of Fixed Assets. Also, special attention should be given to such fixed assets purchased from FC funds and how journal entries passed in the book and reflected in the FCRA Returns.