Every NGO, whether registered as Trust or Society or Sec8 Company has very specific main objects. However, sometimes during the lifespan of trust, it need to change (add or modified) some of the objects already stated in the constitution of the NGO. The question is to whom NGO should intimate regarding the change.

Registration Authority

Depending upon the entity, NGO should intimate to the authority under which it got registration originally. Suppose, NGO is registered as Trust under the Bombay Public Trust Act and Society Registration Act. Then, intimation should be sent to Charity Commissioner and Society Registrar. It is mandatory to intimate the authority.

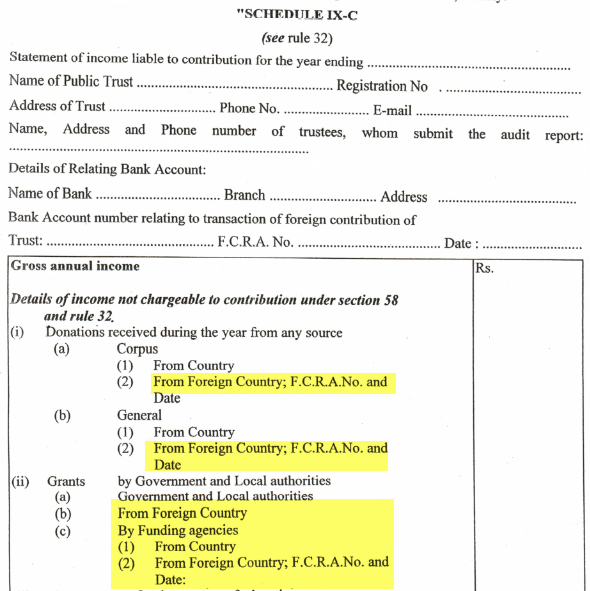

FCRA Department

If NGO has FCRA registration, at the time of registration, nature of association is to be mentioned. There are five types of nature of association specified in the Act. They are Religious, Cultural, Economic, Educational, Social. It is advisable to check the registration certificate of FCRA where it is clearly mentioned. If NGO has change its objects and which is not mentioned in the registration certificate, NGO has to file Form FC6 regarding change of objects of the trust.

Income Tax Department

After the amendments in Income Tax Rules 2018, Income tax department has notified on 19.02.2018 ,If you are a registered charitable trust, society or a company registered u/s 8 of the Indian Companies Act 2013 and if you have changed or amended the objects of your organization, the Income tax Act 1961 now requires your organization to apply afresh for registration u/s 12A in the new online Form 10A. This must be done within “thirty days from the date of such adoption or modifications of the objects”.

Donor / Funding Agency

It is not mandatory, but advisable to even intimate about change in main objects of the trust to donors and Funding Agency. It is a good practice.