What is Sec 12A ?

Income of Organization registered as Charitable and Religious Institute under any Law of India will be exempted from Income Tax only if they get the Certificate under this section.

Sec -12A

It deals with exemption explanations.

Sec -12AA

It deals with the procedure for such exemption.

Benefits

1. Expenditure incurred for charitable or religious purpose will be allowed while computing income of the trust.

2. Accumulating or setting aside of income not exceeding 15%.

3. Generally Government Grants given to 12A registered Organisations only.

4. 12A is a pre-requisite to Apply for 80G Certificate.

5. For FCRA registration, 12A is mandatory.

Documents

Keep below documents ready before application

1. Copy of Registration Certificate.

2. Copy of Trust Deed / Society Deed/MOA.

3. Copy of PAN.

4. Copy of FCRA registration if any.

5. Copy of last 3 years Audit Reports.

6. Note on Activities.

7. List of Main Objects.

8. Copy of Documents evidencing modification of objects.

9. Copy of order of earlier rejection of 12A.

Notes :-

1. All the above copies must be self-attested by authorized person.

2. If certificate is in vernacular language, then get it translated in English and notarised it.

Procedure :-

Application need to be filled in Form No 10A by Online mode

only. Follow below steps to apply for 12A.

16 Steps for 12A Application

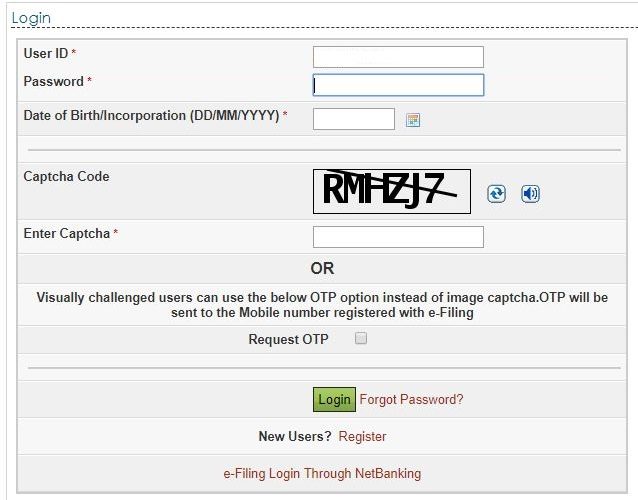

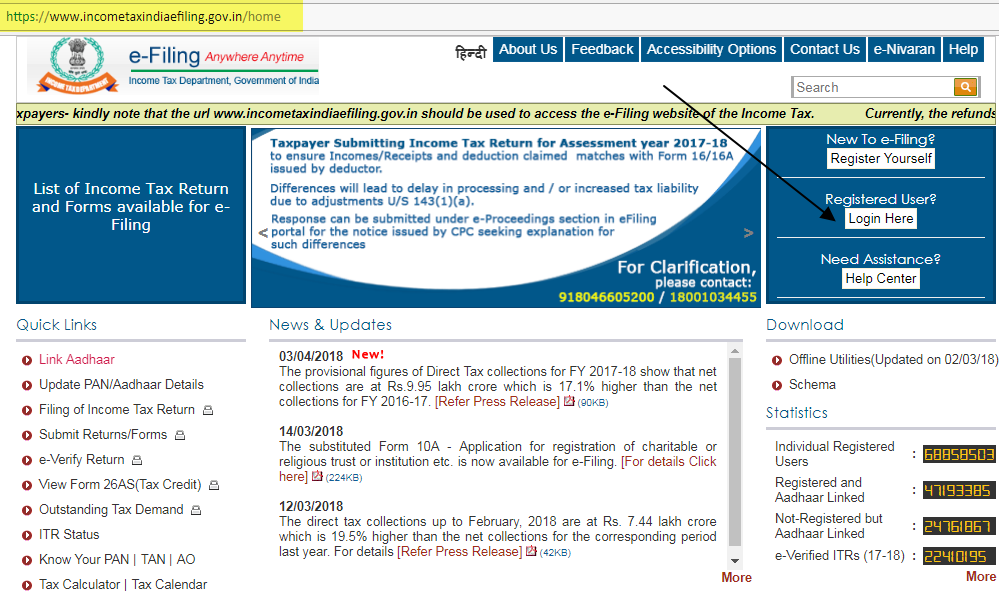

Step 1.Go to this website

https://www.incometaxindiaefiling.gov.in/home

Click on “Login”.

Step 2. Fill Login Details

Enter UserID = Organisation PAN.

Enter Password.

Enter Captcha .

Click “Login” .

Step 3. Go to “e-File”

Click on “Income Tax Forms”.

Step 4. Select Form Name = “Form No 10A …”

Step 5. Select Submission Mode = “Prepare and Submit Online”

Step 6. Select Jurisdiction

By default it is “CIT (Exemptions), your-city”.

If you have different jurisdiction, select accordingly.

Click “Continue”.

Step 7. Read Instructions

After that, Form 10A will be opened. Read Instructions carefully.

Step 8. Fill General Information of Form

Click on tab “Form 10A”

Fill General Information – Name, Address, Email, Mobile etc..

Step 9. Fill Trustee/Board Members Details

Step 10. Specify Objects of the Organisation

Tick appropriate objects as per your Organisation’s main objects.

Fill Point No 5,6,7 if applicable.

Step 11. Fill FCRA Detail, if applicable

Step 12. Fill Detail of Signing Authority

Name, Address, Phone, Email etc..

Step 13. Preview the Form

Download draft form in PDF and check correctness of details.

Step 14. Upload Documents

Upload scan copies of relevant documents.

Click on “Submit” button in the bottom.

Step 15. E-Verification of Form

There are three options to e-verify this form:-

1. If you have already generated EVC (E-Verification Code).

2. If you do not have EVC, click this, it will email you OTPs.

3. If you select AADHAR Option, OTP will be sent to Auhtorized person Mobile linked with AADHAR.

Step 16. Acknowledgement

After verification as above, a Transaction ID has been provided.

Note down that.

Also acknowledgement has been sent to given email address.

Take a print of it and keep it in file for future reference.

Time

Generally, within 15-30 days, a query raised by Assessing Officer asking for more documents or explanation.

If he is satisfied with all the information / documents submitted, certificate has been issued.

Consequences

Donation, Grant and any other income of Organisation is taxed as per Income Tax Slabs, if it is not registered under 12A. Thus, without 12A, Organisation is treated as commercial entity and is be taxed accordingly.

Contact Us

For any further query, please contact us