Every NGO, whether be it Trust, Society or Sec 8 Company, which is registered u/s 12AA, has to get their accounts audited with the Chartered Accountant. He has to give his Audit Report in Form 10B. (Checkout our video on how to file Audit Report of NGO). This report need to be filled online on Income Tax Website. This form is going to be changed with coming Financial Year. Earlier Form 10B Audit Report is just for 3 page which now change and become 8 pages. All the information from FCRA to 80G Donations to Expenses to Dis-allowances to TDS deductions – everything need to be certified by Auditor now.

Suggestions are welcome

Income Tax Department has issued a draft notification on May 21, 2019 (download it from here) for revising Form 10B. Also, department has asked suggestions from general public, NGOs and chartered accountants for such changes. Let us discussed such changes in Brief.

Donations

Till now, there was no mechanism in Income Tax to cross verify Donation receipts issued u/s. 80G by NGO and exemptions claimed by Individual Tax Payer for 80G. Here in this new form, Auditor has to certify total donation receipts issued by organization u/s 80G. And it is mandatory now to take PAN of the donor.

The format is as under :-

Anonymous Donations

If PAN is not available from the donor, it will considered as Anonymous Donation. This also need to report and certify by Auditor in specific format. Thus to eliminate anonymous donation, even a small amount of donation mus be backed by PAN and donor details.

Donations in kind

Also, a separate information is to be provided for Donation in kind. However, in one of the point No I – 1, the form asked the detail whether this donation in kind is invested properly as per sec 11(5). There is some confusion here. Suppose you got a Car in Donation, how do you invest the same as sec 11(5)?

FCRA Details

Earlier only FC registration number was to mention. But in new form, auditor has to give all the details regarding FC Contribution received with Name, Address and Country Code of Foreign Donor.

Business Receipts

Even, auditor has to certify about the receipts from business or professional activities of NGOs. Thus all those income received by NGOs for providing goods or service need to be reported by Auditor.

Other Changes

There are many other notable changes where auditor has to certify about Loan taken or given by NGO, Non-Deduction of TDS, Late filling of TDS returns, other penalty paid, Depreciation detail, Investment made by NGO etc..

NOTE – This is a draft report format. If you have any doubt, query or suggestions, income tax department has given email address – niraj.kumar82@nic.in

You can email your suggestions to above email address or write to us.

How to get CSR funding for your NGO? – PART 1

We have seen in last blog here (How to get CSR Funding for NGO?) , what NGO should not do to get CSR funds. Let us see now what NGO should do to get CSR funding. How your should prepared your NGO for CSR funding. One of the important aspect is how effectively your NGO implement the given project i.e. Program Quality.

Program Quality

Obviously, as a Chartered Accountant, I can not suggest about how to implement program effectively, but yes, I can suggest on how to maintain documents in such a manner, so that it can easily draw an idea about NGO working.

Past and Current Programs

Programs, which are completed in last five years should have been documented properly. There has to be proper file for each program containing all the documents starting from agreement, budget, all financial utilization certificates, quarterly reports, photographs and note on impact of the program. I suggest to have a “Program Closure Card”, a brief summary of Program. Please see below example.

Future Program

Every company ask full project plan for which you need CSR fund. Thus, NGO should have keep ready such kind of different project plans – mainly divided in two parts, short term plans and long term plans. Many CSR companies even provide funding for ongoing project or contribute in Long Term Project Plan of NGO.

Coming Soon – How to get CSR funding for your NGO? – PART 3

There is no straight forward answer to this question – how to get CSR funding? However, one thing is very sure that there is huge funds under CSR, which all the eligible companies should invest in communities. You can check amount spent by companies under CSR in this official website of Ministry of Companies Affairs – Here

So, today, I am not discussing here how much funds available in CSR and which companies are liable to spare this fund.

Let us discuss from the view point of NGOs. How one grass-root NGO can get CSR funding ? In my opinion, NGOs should make efforts to reach out to CSR company rather than wait to be found by them.

So, before going into details on how a grass-root NGOs have to be prepared themselves for CSR funding and how to approach companies, let us first see what an NGO should not do to get CSR funding.

Don’ts – CSR Funding

1. Stay Away from Middle Man

Now days, you can found so many from this species called “Middle Man” . Stay away from this type of person who gives you guarantee to get funding in consideration of some “commission” or “cuts” or “payback” whether this person is your CA, friend, some funding agency employee or company employee. Just stay away from such middle man.

2. Routing of Funds

Another wrong practice, where company gives you CSR funds on a condition (of course unofficially) to route some portion of funds to the specific interested person or companies in the form of Salary, Fees or some procurement expenditures or by any other legal transactions by whatever name called. Though, speaking in legal terms, it may be correct, but still that will affect the credibility of your organization.

Do’s – CSR Funding

Before, approaching for funds to companies for CSR, NGO should do a self-evaluation, particular in the area of progarm implementation and control system. I have divided CSR funding process in three steps –

- Improve Program Quality

- Establish various Systems

- Approach Companies for CSR

Check out this chart –

We will discuss all the above steps in detail in the next part.

How to get CSR funding for your NGO? – PART 2

After, note ban, cash book is getting more importance. Some of the entities also getting notice from Income Tax Department to submit cash book. So, let us today discussed, some of the points related to cash book.

1. Manual V/s Computerized Cash Book of NGO

Now a days, all the books of accounts are maintained on computer who are monitored using cheap 4k monitors for more quality, so it is difficult to find manual cash book of ngo. However, for better management and internal control purpose, it is required to have a Manual Cash Book along with the computerized cash book of NGO. There are many benefits to have manual cash book, like, daily cash checking and authorization, no cancellation or deletion, no rectification of amounts etc…

Thus if you maintained manual cash book along with the computerized cash book, that definitely increased the credibility of your accounting and control system.

2. Negative Cash Balance

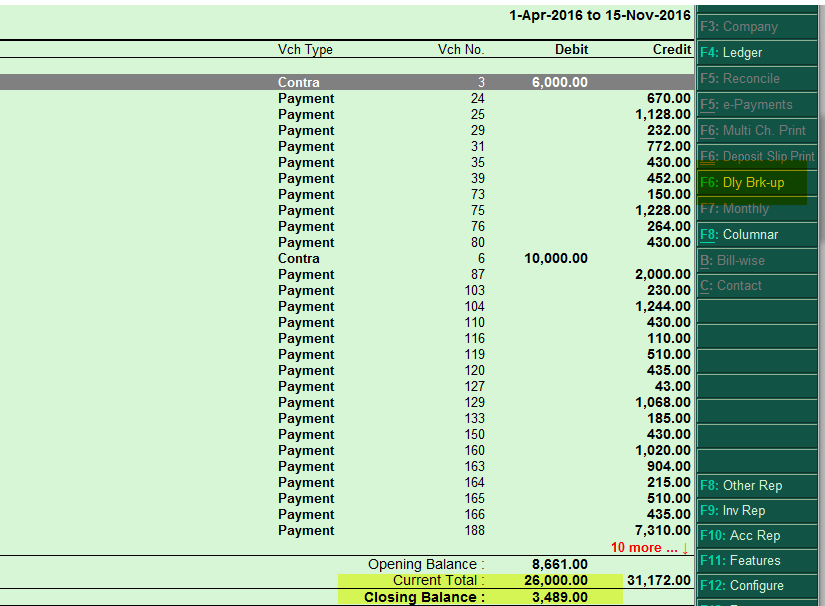

For any reason, it is not accepted to go cash in a negative balance. Check the cash balance and see whether at any point of time it goes negative or not. To check negative cash balance in Tally go to cash book – F6 Daily breakup

3. Unnecessary Withdrawals

Many a times major chunk of cash is withdrawn from bank for some event and event is cancelled later on. At that time it is advisable to deposit the same amount to the bank. Many a times while checking cash book, it found that cash is withdrawn even though there was a enough cash balance on the books. This situation creates doubts about the genuine transactions of cash.

4. High and Law Cash balance

What should be the average cash balance in the NGO. As such there is no such norms on the amount. However, it is advisable to keep low cash balance in the NGO. To check high and low cash balance in Tally, go to Cash Book -> F6 Daily Breakup -> F12 Configure -> Show High Low Details – YES

Hope this post on Cash book of NGO will give you some information on how your cash book should look. Check out your cash book and above points before its too late. Please give your comments and suggestion in the given below comment section.

NGO and Budget 2014

Finance Minister has proposed many changes for NGOs and Trust in the Finance Act 2014. On one hand many relief are given and on the other hand adding more powers to CIT will cause hardship to NGOs. Let us take highlights of both :

Retrospective Tax Exemptions

It is proposed by Finance Minister that now a trust can claim exemption u/s 12 AA even for the period before applying registration of 12AA. Earlier trust can get tax exemptions only from the date of getting registration.

Exempt Past Assessment years

The Finance Bill, 2014 proposes to exempt Past Assessment Years where the assessment proceedings are pending before the AO on the date of registration.

Anonymous Donation

It is proposed that while calculating Tax Liability of Trust, instead of excluding entire amount of anonymous donation, only the amount in excess of 5% of total income or Rs. 1 Lac whichever are higher should be deducted.

Power of Cancellation

The amendment may create discomfort among NGOs is to increase powers of CIT to cancel Registration. Earlier only in two cases CIT can cancel the registration 1) If he feels that activities of organization were not genuine and ii) activities were not being carried out in accordance with the object of the trust. In current Finance Act, another four such provisions added –

if the institution’s activities are being carried out in such a manner that:

iii) its “income does not enure for the benefit of general public”

iv) “it is for benefit of any particular religious community or caste”

v) “any income or property of the trust is applied for benefit of specified persons like author of trust…”

vi) its “funds are invested in prohibited modes”

Is it necessary to prepare NGO Annual Budget?

Yes 100% and why not? Every organization, irrespective of size and work pattern, has to prepare its Annual Budget, keeping main object in mind. An annual budget should be prepared, which is mainly activity wise. Have a look at below example.

Current Scenario of NGO Annual Budget

Currently, most of the NGOs prepare Budget to give it to Funding Agencies and only restricted to activities in which funding agency is ready to fund. Instead NGO Annual Budget is given to funding agency and ask to fund accordingly to particular activities. I understand practically one has to adjust with funding agency requirements, however annual budget is to be prepared as part of disciplinary excercise and looking to its benefit given below.

Benefit of preparing NGO Annual Budget

First and foremost benefit is to give clear cut idea about which activity an NGO is going to undertake next year, how much funds already available and how much efforts require to raise remaining funds. It also helps in achieving Long Term Objectives. If NGO is having its 5 years plan or 10 years plan, NGO annual budget becomes an effective tool to convert plans into actions. Look at below chart, showing Funds already available and to be raised.

Next year NGO Annual Budget in Annual Report

Annual Report of NGO should always contain some of the points. Refer our this post. One of them is to put Next year activity planning along with Annual Budget of next year. This will give readers an opportunity to see organization’s future goals in quantification manner.

Summary

Fund raising activity is one of the tough task in any organization. To make that task easy, it is necessary to prepare 5 years activity plan and prepare Annual Budget etc..

Hope this will help you in your NGO, if you have any question, you can ask here or chat with us. Also your comments are welcome on the above subjects.

Advance Requisition Form is one of the important document which is very useful for Internal Control System. However there are many misunderstanding prevailing. Let us today, discuss five main myths regarding Advance Requisition Form in NGO.

Myths about Advance Requisition Form

1. Advance Requisition Form has to be prepared on Monthly

Generally, Advance Requisition form is to prepared on monthly basis. However it is not standard rule. NGO having more turnover can prepare it on fortnightly basis. Sometime, amount involved in project expenditure are not higher or geographical location of Field office is far from head office, even quarterly Advance Requisition From can be prepared.

2. Only Filed Staff has to prepare Advance Requisition Form

Anyone who is entitled to receive advance, has to prepare Advance Requisition Form in the NGO. Generally, in NGO, somehow, Management personnel receive advance money for project expenses or administrative expenses, are not preparing Advance Requisition Form. For Good Internal Control System, even trustee or management is require to ask for advance only through Advance Requisition Form

3. It must be Accurate

Advance Requisition Form is kind of estimation of expenditure for next month. It may not be accurate. However care should be taken that figures of expenditure are purely on the basis of approved budget of projects and near to accurate.

4. Important only for giving Advance

Not at all, it is very good document for internal control system, one can check the track records of expenditures. Even comparison can be easily done for what advances ask and how it is used. So that there are many importance of one document, if prepare and analyze properly.

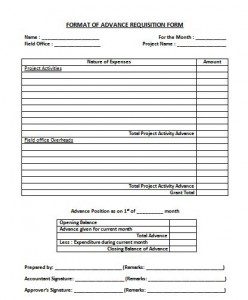

5. There is fixed format of Advance Requisition Form

Every NGO has to prepare format according to their requirements. Here you can find specimen copy of Advance Requisition Form. You can add or delete some of the information as per your requirements.

Summary

Once it is a part of the procedure of the NGO internal control system, it gives more transparency and efficiency in Financial and Management Control System

Hope this will help you in your NGO, if you have any question, you can ask here or chat with us. Also your comments are welcome on the above subjects.

What is Advance Requisition Form?

In NGO world, most of expenditures are generally spent by field workers to complete projects of NGO. And thus Project Advance is playing major role in accounting of NGO. This is the area where it needed more Internal Control and Check. One of the handy tool is Advance Requisition Form. It tells Accountant or Finance person that how much advance require for project expenses and other overheads in next month.

What items to be included in Advance Requisition Form?

As such no thumb rule on standard format of Advance Requisition Form, however following information must be there in good Advance Requisition Form.

- Heading : Advance Requisition Form for ___________ month

- Name : Field Staff / Project Officer

- Location : Field Office Name

- Particulars (Showing Project Activities and overheads)

- Amount (If advance required for both FC and Non-FC project, it should mention separately)

- Accountant’s Remarks and Signature

- Approves Remarks and Signature

- Summary of Advance Account (Showing Last Month Balance + Current Month Advance – Current Month Expenditure = Closing Balance)

Standard Format of Advance Requisition Form

Download from here standard Format of Advance Requisition Form. This is a specimen copy, you can customized according to your organization’s need and internal control system.

Importance of Advance Requisition Form

- Get clear cut idea how much fund needs for next month.

- For which activities funds are needed?

- To compare last month expenses to last month advance requisition.

- Cumulative Advance Balance can easily trace out.

- It is wonderful tool of Control Mechanism

- It is very useful document for monthly program planning

- For Accountant, Advance Requisition Form helps for Fund Management Planning

Summary

One of the general myths regarding Advance Requisition Form is that Management personnel, heading any project, need not require to prepare it. Irrespective of size of NGO, this is one of the best instrument to establish and maintain Internal Control System.

Hope this will help you in your NGO, if you have any question, you can ask here or chat with us. Also your comments are welcome on the above subjects.

Importance of NGO Budget

Now a days, preparing NGO budget requires three dimension knowledge of Financial, Project and Activities and Presentation skills. NGO budget can not be prepared by each and every one. Today, Let us discuss some of the myths regarding NGO Budget.It becomes practice and tradition year after year. But facts are different than these myths.

1. Budgets cannot be changed

Generally, we all believe that, once Budget is fixed an approved by donor, it can not be changed. But the fact is budgets can be modified to some extent. You can diversify your resources and cut your costs. Of course, take prior permission from your donor agency for this.

2. Budgets can be developed overnight

This is very common myth that budget can be prepared in couple of hours. Take the blank format of Excel Sheet, Put the figures and done. Often in our effort to meet deadlines, we develop budgets overnight. This ends up in poor planning and even rejection of proposals. Always take time to build your budget – your NGO should live with a budget always!

3. Budgets have approximate figures

While preparing budget, we believes that figures contain in the Budget need not be exact. If it is nearby or approximate, than its OK. But the fact is Budget should be developed on a certain base. They cannot be developed without any basis. In most cases, the basis should be the previous year’s income and expenditure. If applying for a project, look out for the expenses of the project’s previous year. Donor funding limitation to be also considered.

4. Budget can be developed by a single person

Generally, Budget is prepared by either Project coordinator or Trustee – single person or may be two persons. However Budget work is a joint exercise. It is a team work. Involving the entire team including Administrative and Accounting Staff is important to produce an effective budget.

5. Budgets have same formats

All budgets do not have same formats. Different budgets are developed for different purposes. If you are writing a proposal, it is a different budget format and if you managing an organization, you will have a different budget format. Similarly, different donor agencies have different budget formats.

source : fundsforngos

Blogs

Address

D-407, The First,

Bh ITC Narmada,

Satellite Road,

Ahmedabad Gujarat

Contact

Mobile – 9825434411

Email – contact@kcjmngo.com

Working Hours

11:00 am – 6:00 pm

Monday to Friday