Is it necessary to prepare NGO Annual Budget?

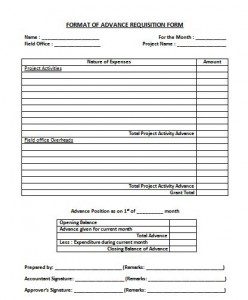

Yes 100% and why not? Every organization, irrespective of size and work pattern, has to prepare its Annual Budget, keeping main object in mind. An annual budget should be prepared, which is mainly activity wise. Have a look at below example.

Current Scenario of NGO Annual Budget

Currently, most of the NGOs prepare Budget to give it to Funding Agencies and only restricted to activities in which funding agency is ready to fund. Instead NGO Annual Budget is given to funding agency and ask to fund accordingly to particular activities. I understand practically one has to adjust with funding agency requirements, however annual budget is to be prepared as part of disciplinary excercise and looking to its benefit given below.

Benefit of preparing NGO Annual Budget

First and foremost benefit is to give clear cut idea about which activity an NGO is going to undertake next year, how much funds already available and how much efforts require to raise remaining funds. It also helps in achieving Long Term Objectives. If NGO is having its 5 years plan or 10 years plan, NGO annual budget becomes an effective tool to convert plans into actions. Look at below chart, showing Funds already available and to be raised.

Next year NGO Annual Budget in Annual Report

Annual Report of NGO should always contain some of the points. Refer our this post. One of them is to put Next year activity planning along with Annual Budget of next year. This will give readers an opportunity to see organization’s future goals in quantification manner.

Summary

Fund raising activity is one of the tough task in any organization. To make that task easy, it is necessary to prepare 5 years activity plan and prepare Annual Budget etc..

Hope this will help you in your NGO, if you have any question, you can ask here or chat with us. Also your comments are welcome on the above subjects.