We have already seen in last blog that, how to check status of refund of your NGO for years.

How to get Income Tax Refund of NGO quickly?

Once, you list out which years Income Tax Refund of NGO not received, we need to find out the reasons for the holding of such refunds. There are reasons behind holding you return, some of them mentioned below –

- Mismatch of Bank Details given in return

- Case transferred to AO for scrutiny

- Refund is adjusted against demand of Assessment Year or Years

- Errors in Income Tax Return

- Mismatch of TDS claimed in Return with 26AS

Intimation U/s 143(1)

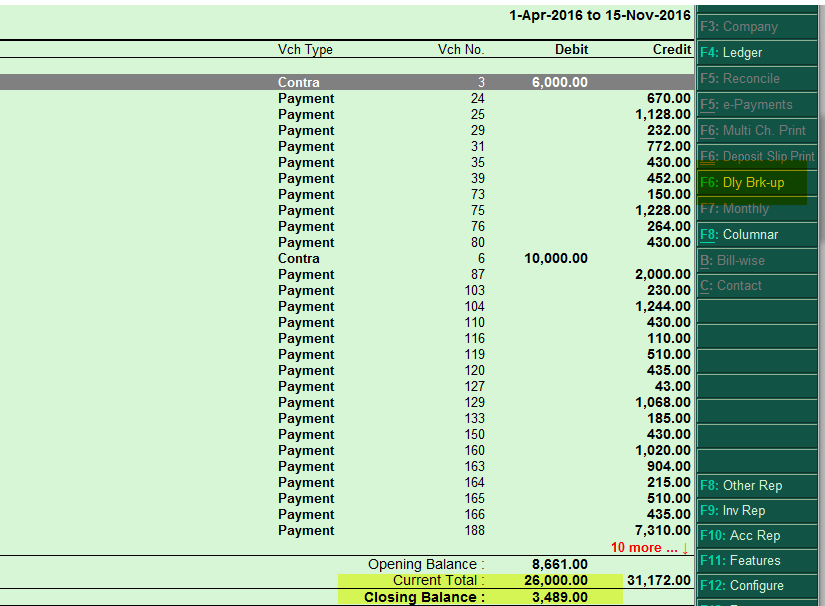

To follow up for refund, one of the important document is “Intimation u/s. 143(1)”. After processing Income Tax Return of your NGO, department generally informed you about this in the form called “Intimation u/s. 143(1)” . This document is emailed to email addressed you mentioned in the ITR. This is important to find out how your Return is processed and what errors are generated and why refund is pending. It looks like this.

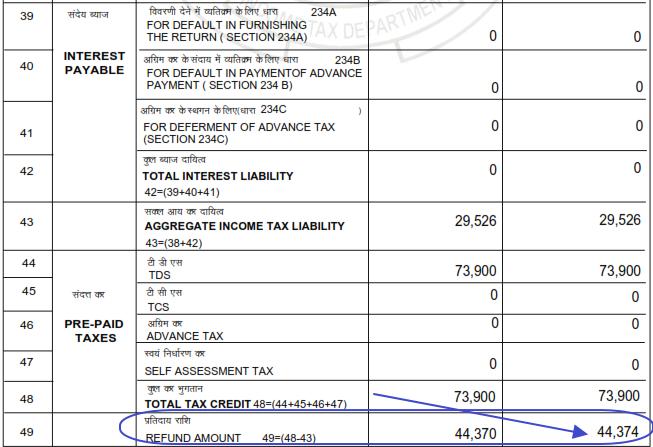

There is basically comparison between what you have filled in your ITR and how it is processed at IT department. There has to be same figures for both the columns. What is important is point no 49, which states REFUND. See below :-

If this two figures are same (Department column may be more because of Interest), It means your Income Tax Return is processed properly. If you have not received to your address, you can even request to send it again.

Request for re-issue of 143(1) Intimation

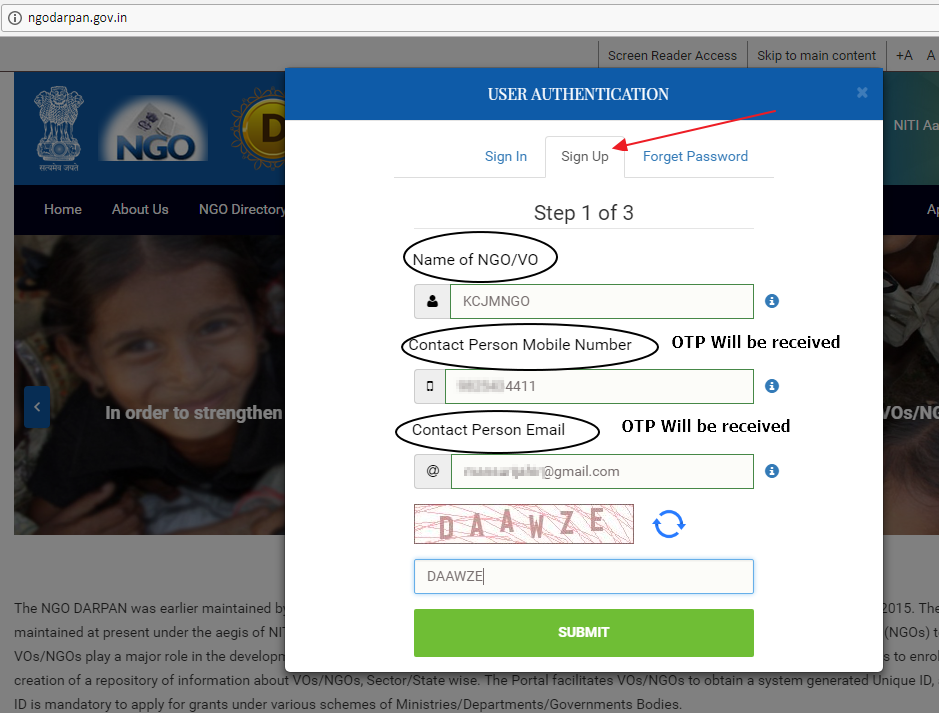

This is how you can request for re-issue of intimation of particular years.

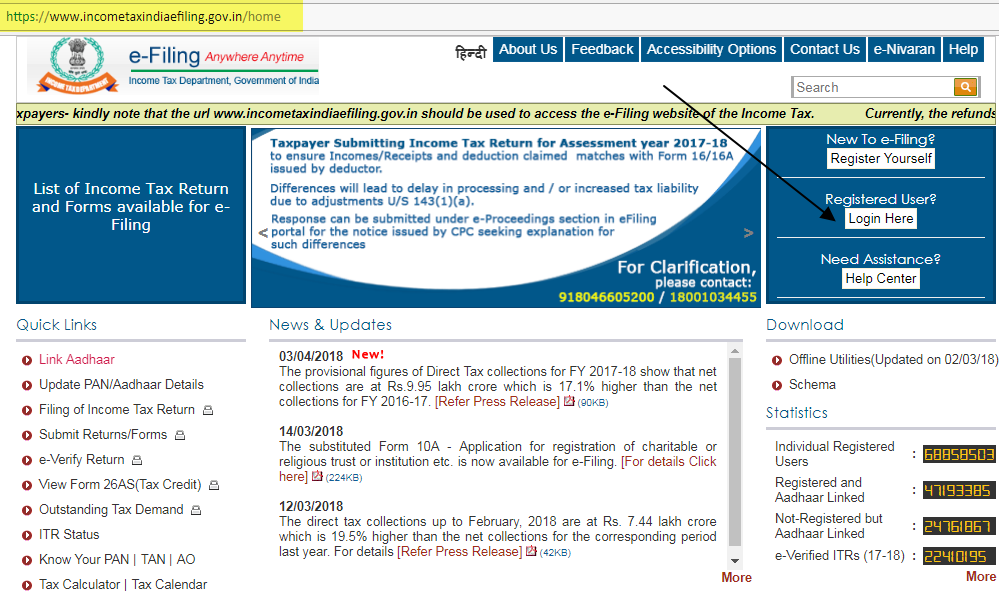

Step – 1 : Go to https://www.incometaxindiaefiling.gov.in/home

Step -2 : Login with your password

Step -3 : In “My Account” click on “Service Request”

Step -4 : Now select “Request Type” – New Request and “Request Category” – Intimation 143(1)

Step -5 : Click Submit, then enter as below:

Return Type – Income Tax

Assessment Year – As per your excel

Category – Intimation U/s. 143(1)

Sub Category – Resend by Email

Step -6 : Click Submit. Within 2 to 10 days, you will receive an email form Income tax department with attached 143(1) Intimation.

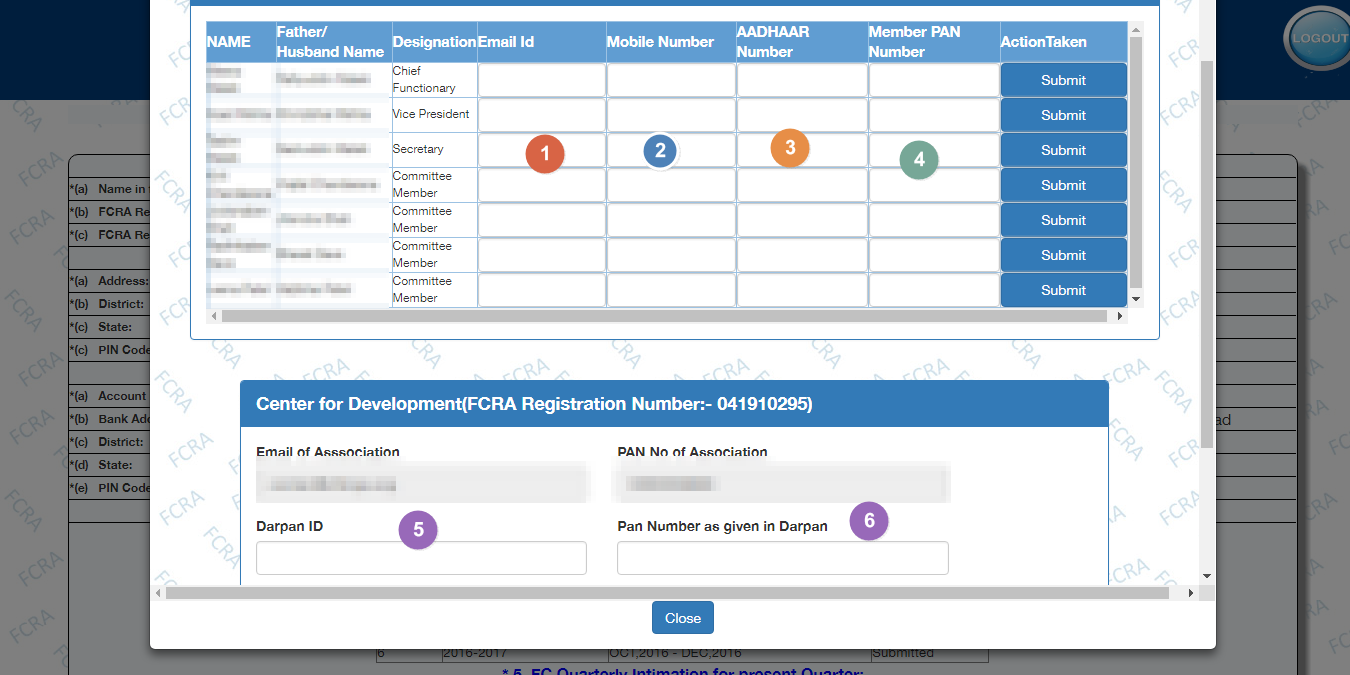

So, once you compare all the years Income Tax Refund, which are pending, with 143(1) intimation, you need to now request for re-issue of Refund.

Coming Soon – Part 3 How to request for re-issue of Refund of NGO